第九章测试1.A fund manager announces that the fund's one-month 95% VaR is 6% of the size of the portfolio being managed. You have an investment of $100,000 in the fund. Which of the following options interpret the portfolio manager's announcement best?( )

A:There is a 5% chance that you will lose $6,000 or more during a one-month period. B:There is a 5% chance that you will lose $6,000 at most during a one-month period. C:There is a 5% chance that you are expected to lose $6,000 during a one-month period.

答案:A

2.Suppose that each of two investments has a 0.9% chance of a loss of $10 million and a 99.1% chance of a loss of $1 million. The investments are independent of each other. What is the VaR for one of the investments when the confidence level is 99%?( )

A:$9.1 million B:$1 million C:$10 million 3.Suppose that each of two investments has a 4% chance of a loss of $10 million, a 2% chance of a loss of $1 million, and a 94% chance of a profit of $1 million. They are independent of each other. What is the VaR for one of the investments when the confidence level is 95%?( )

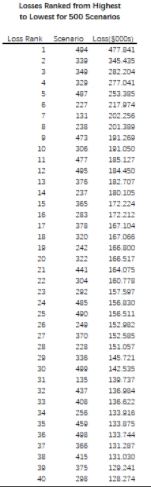

A:$10 million B:$1 million C:$8.2 million 4.If the daily, 90% confidence level, VaR of a portfolio is correctly estimated to be $5,000, one would expect that in one out of:( )

A:10 days, the portfolio value will decline by $5,000 or less B:90 days, the portfolio value will decline by $5,000 or less C:10 days, the portfolio value will decline by $5,000 or more 5.The losses for the four-index example is the right table. What is the 95% one-day VaR (500 scenario)?

( )

( ) A:$156.511 B:$142.535 C:$166.517

温馨提示支付 ¥3.00 元后可查看付费内容,请先翻页预览!