提示:内容已经过期谨慎付费,点击上方查看最新答案

国际金融学

- If the demand for Home exports decreased abroad, the Home fall in output would be greatest______. ( )

- Assume the asset market is always in equilibrium. Therefore a fall in Y would result in_____。( )

- If the dollar interest rate is 10 percent and the euro interest rate is 6 percent, then _______.( )

- The expectation of future devaluation causes a balance of payments crisis marked by_____.( )

- Which of the following statements is the MOST accurate? ( )

- Changes in the money supply growth rate ______. ( )

- Why does an exchange rate-output combination lying above both DD and AA jump first to AA in equilibrium? ( )

- Advocates of flexible exchange rates claim that under flexible exchange rates, the central bank of _______. ( )

- Comparing fixed to flexible exchange rate, the response of an economy to a temporary fall in foreign demand for its exports is _______. ( )

- If most of the shocks that buffet the economy come from the output market shocks, then______. ( )

- Under the monetary approach to the exchange rate, _______. ( )

- Which one of the following statements is the MOST accurate? ( )

- The main reason(s) why governments sometimes chose to devalue their currencies is (are)_____. ( )

- Under sticky prices, _______. ( )

- Temporary tax cuts would cause______. ( )

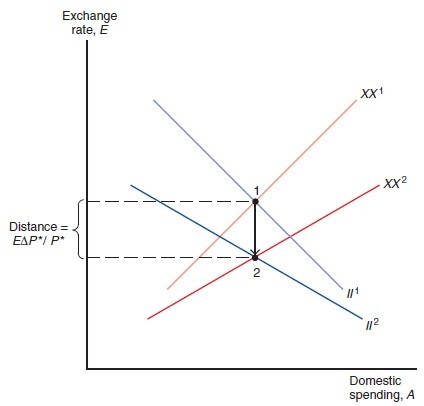

Refer to the graph above. The movement from point 1 to point 2 is stimulated by a disequilibrium in which there is domestic ________ and ________. ( )

- Which of the following statements is the MOST accurate? ( )

- GDP is different than GNP in that______.( )

- Which of the following statements is MOST accurate? ( )

- The official settlements balance or balance of payments is the sum of ______. ( )

- If an economy is in a liquidity trap, then the nominal interest rate is ________ and the more effective policy that can be used to stimulate the economy is ________. ( )

- The first generation theory of BOP crisis thinks fundamentals matter and the crisis is unpredictable, while the second generation theory thinks beliefs matter and the crisis is predictable. ( )

- The dollar is sometimes called a vehicle currency because of its pivotal role in many foreign exchange deals. ( )

- An increase in disposable income worsens the current account. ( )

- Countries where investment is relatively productive should have current account deficits. ( )

- The U.S. has the most negative net external wealth around the world.( )

- The real exchange rate, is defined as the price of the home goods in terms of the foreign goods. ( )

- We can use cross rates to help us check on whether a triangular arbitrage opportunity exists. ( )

- Money demand behavior may change as a result of demographic trends or financial innovations such as electronic cash-transfer facilities. ( )

- According to UIP, for a given euro interest rate and constant expected exchange rate, a rise in the interest rate offered by dollar deposits causes the dollar to appreciate. ( )

- Positive external wealth makes a country a debtor nation.( )

- Discuss the effects of the reunification of eastern and western Germany in 1990 on both Germany and its neighboring European countries.

Assume that the government has a target value, X, for the current account surplus.

(a) What is the goal of external balance?

(b) Assume that we are dealing with only the short run, what are the values of P and P∗?

(c) Given fixed P and P, what would happen if E rises?

(d) Given P and P, what would happen if T decreases, i.e., an expansionary fiscal policy?

(e) Given P and P, what would happen if G increases, i.e., an expansionary fiscal policy?

(f) Given all of the above, what is the relation between the exchange rate, E, and fiscal ease, i.e., an increase in G or a reduction in T?

(g) Assume that the economy is in external balance. What will happen if the government maintains its current account at X, but devaluates the domestic currency?

(h) Assume that the economy is at external balance. What will happen if the government raises E?

(i) Assume that the economy is at external balance. What will happen if the government lowers E?

Explain why Relative PPP is useful when comparing countries that base their price levels on different product baskets with an example.

If the central bank does not purchase foreign assets when output increases but instead holds the money stock constant, can it still keep the exchange rate fixed at ? Please explain with the aid of a figure.

Describe the chain of events leading to exchange rate determination for the following cases:

(a) An increase in domestic money supply

(d) Increase in growth rate of domestic money supply

(c) Increase in world relative demand for domestic products

(d) Increase in relative domestic output supply

- Consider how the United States balance of payments accounts are affected when U.S. banks forgive two billion in debt owed to them by the government of Argentina.

- What is a vehicle currency?

- Explain how does an increase in the real exchange rate affect exports and imports?

What are the predictions for the long run equilibrium of the Monetary Approach?

Imagine a world with two large countries, Home and Foreign. Evaluate how Home's macroeconomic policies affect Foreign. Compare the small and the large country cases; consider both permanent monetary and fiscal policies.

Please draw a figure illustrating the actions the central bank must take to maintain a fixed exchange rate following an increase in output.

- What are the predictions of the PPP theory with regards to the real exchange rates?

A:if the decrease was temporary and the exchange rate was fixed. B:if the decrease was temporary and the exchange rate was floating. C:if the decrease was permanent and the exchange rate was floating. D:if the decrease was permanent and the exchange rate was fixed.

答案:decrease was temporary and the exchange rate was fixed.

A:a contraction of the money supply. B:a depreciation of the home currency. C:an appreciation of the home currency. D:a decreased demand for domestic products.

答案:higher inflation abroad.

A:an investor should invest only in dollars if the expected dollar depreciation against the euro is 8 percent. B:an investor should invest only in euros if the expected dollar depreciation against the euro is 8 percent. C:an investor should invest only in euros. D:an investor should invest only in dollars.

答案:17percent.AI参考:正确答案是【D:an investor should invest only in dollars.】。如果美元利率为10%,欧元利率为6%,则投资者应只在美元预期对欧元贬值8%的情况下投资。这意味着,当欧元贬值可能性大时,投资者应该投资美元。因此,选项D“投资者应只投资美元”是正确的。其他选项都与问题描述不符。'

A:a sharp fall in reserves and a rise in the home interest rate above the world interest rate. B:a sharp rise in reserves and an even greater rise in the home interest rate above the world interest. C:a sharp fall in reserves and an even bigger fall in the home interest rate below the world interest rate. D:a sharp rise in reserves and a fall in the home interest rate below the world interest rate.

答案:a sharp fall in reserves and a rise in the home interest rate above the world interest rate.

A:The law of one price applies to individual commodities while PPP applies to the general price level. B:The law of one price applies only to the general price level. C:PPP applies only to individual commodities. D:The law of one price applies to the general price level while PPP applies to individual commodities.

答案:They perform rituals and get momentary relief from the anxiety.

A:are neutral in the long run. B:need not be neutral in the short run. C:need not be neutral in the long run. D:affect the real output of the economy.

AI参考:正确答案是【B:need not be neutral in the short run.】。短文中指出货币供应增长率的变化在短期内可能不是中性的。这个句子使用了一个很典型的修辞句式"In the short run...”,意味着该情况不会长期保持不变。所以正确选项是B。在这个上下文中,B选项的含义更符合。同时,在所有的选项中,只有B选项提到了“short run”,这也是为什么它更符合语境的原因。A选项中的“are neutral”与语境不符,C选项中的“need not be neutral in the long run”虽然符合语境,但与题干中的“changes in the money supply growth rate”不相关,D选项“affect the real output of the economy”与题干无关。因此,答案为B。'

A:Asset prices can adjust immediately. B:Production plans can adjust immediately. C:to preserve full employment D:Aggregate demand adjusts faster than output.

AI参考:正确答案是B:Production plans can adjust immediately。在均衡状态中,当汇率-产出组合高于DD和AA时,生产计划能够立即调整,所以会首先跳到AA。在货币经济中,总供给曲线通常向上倾斜,这意味着在产出水平不变的情况下,货币价格的变动会引起汇率的变动。因此,生产计划的调整可以立即影响汇率,进而影响产出水平。其他选项中,资产价格调整需要时间,总需求调整的速度不一定比产出更快,而保持充分就业也不是直接原因。因此,答案为B。'

A:a cooled economy could cool down activity by contracting the money supply without worrying that undesired reserve inflow would undermine its stabilization effort. B:an overheated economy could cool down activity by increasing the money supply without worrying that undesired reserve inflow would undermine its stabilization effort. C:an overheated economy could cool down activity by contracting the money supply without worrying that undesired reserve inflow would undermine its stabilization effort. D:an overheated economy could cool down activity by contracting the money supply without worrying that undesired reserve outflow would undermine its stabilization effort.

A:output actually falls less under fixed rate than under floating rate. B:output grows in a fixed rate system and falls in a flexible system. C:output actually falls more under fixed rate than under floating rate. D:output actually remains the same under fixed rate than under floating rate.

AI参考:正确答案是A:output actually falls less under fixed rate than under floating rate。在固定汇率和浮动汇率的比较中,一个经济体对其出口产品暂时性外需下降的反应,在固定汇率下,产出下降的幅度小于在浮动汇率下。因此,选项A是正确答案。其他选项都与题目描述不符。'

A:flexible exchange rates are better than fixed exchange rates only in the short-run. B:fixed exchange rates are better than flexible exchange rates. C:which system is chosen is not important. D:flexible exchange rates are better than fixed exchange rates.

AI参考:答案为D:flexible exchange rates are better than fixed exchange rates.原文中提到如果经济的大部分冲击来自产出市场,那么相对固定汇率制度来说,灵活汇率制度在长期内更优越,所以选项D正确。其他选项在原文中没有依据。因此,答案为D。'

A:a rise in the money supply will cause immediate currency depreciation. B:a rise in the money supply will cause currency depreciation. C:a reduction in the money supply will cause immediate currency depreciation. D:a rise in the money supply will cause immediate currency appreciation.

A:Appreciation is a rise in E B:Appreciation is a fall in E when the exchange rate floats while revaluation is a fall in E when the exchange rate is fixed. C:Appreciation is a fall in E when the exchange rate floats while revaluation is a rise in E when the exchange rate is fixed. D:Appreciation is a rise in E when the exchange rate floats while revaluation is a rise in E when the exchange rate is fixed.

A:devaluation hurts foreign currencies. B:devaluation improves the current account and increases foreign reserves held by the central bank. C:devaluation makes domestic services more expensive in relation to foreign services. D:devaluation makes domestic goods more expensive in relation to foreign goods.

AI参考:正确选项是B:devaluation improves the current account and increases foreign reserves held by the central bank.原文中提到“The main reason(s) why governments sometimes chose to devalue their currencies is (are)”,说明政府选择贬值货币的主要原因之一是改善经常账户,增加中央银行持有的外汇储备。因此,选项B是正确答案。选项A、C、D虽然也涉及到了贬值货币的影响,但并不是政府选择贬值货币的主要原因。'

A:an interest rate rise is associated with lower expected deflation and a long-run currency appreciation, so the currency appreciates immediately. B:an interest rate rise is associated with lower expected inflation and a long-run currency appreciation, so the currency appreciates immediately. C:an interest rate rise is associated with lower expected inflation and a long-run currency depreciation, so the currency appreciates immediately. D:an interest rate rise is associated with lower expected inflation and a long-run currency depreciation, so the currency depreciates immediately.

AI参考:正确选项是【B:an interest rate rise is associated with lower expected inflation and a long-run currency appreciation, so the currency appreciates immediately.】句子中提到“在黏性价格的情况下,利率上升与预期的通货膨胀率下降和长期货币升值有关,因此货币立即升值。”根据句意和选项,B选项符合语境。其他选项中,A选项中的“货币立即升值”与句子意思不符;C选项中的“货币立即贬值”也与句子意思不符;D选项中虽然提到了“货币贬值”,但并没有明确指出是立即贬值,因此也不符合语境。'

A:the DD-curve to shift left. B:the AA-curve to shift right. C:the DD-curve to shift right. D:the AA-curve to shift left.

AI参考:正确答案是C:the DD-curve to shift right.根据题意,临时减税会导致DD-曲线向右移动。在经济学中,DD-曲线代表税收对经济活动的影响,减税会导致DD-曲线向右移动,从而刺激经济活动。因此,选项C是正确答案。其他选项的含义与题意不符。'

A:overemployment; trade surplus B:overemployment; trade deficit C:unemployment; trade deficit D:inflation; unemployment

A:Absolute PPP does not imply relative PPP. B:Absolute PPP implies relative PPP. C:Relative PPP implies absolute PPP. D:Absolute PPP is inversely related to relative PPP.

AI参考:A. GDP is a measure of output whereas GNP is a measure of incomeB. GDP is a measure of income whereas GNP is a measure of outputC. GNP is a measure of output whereas GDP is a measure of incomeD. GNP is a measure of income whereas GDP is a measure of expenditure答案为 A. GDP is a measure of output whereas GNP is a measure of incomeGDP和GNP是两个不同的概念,前者代表产出,后者代表收入,因此答案为A。选项B和C中两者的位置颠倒了,D项错误,GDP不衡量开支。故选A。'

A:A relative decline of U.S. output causes a long-run depreciation of the dollar against the euro, while a relative decline of European output causes a long-run real appreciation of the dollar against the euro. B:A relative expansion of U.S. output causes a long-run appreciation of the dollar against the euro, while a relative expansion of European output causes a long-run real depreciation of the dollar against the euro. C:A relative expansion of U.S. output causes a long-run depreciation of the dollar against the euro, while a relative expansion of European output causes a long-run real appreciation of the dollar against the euro. D:A relative decline of U.S. output causes a long-run depreciation of the dollar against the euro, while a relative expansion of European output causes a long-run real appreciation of the dollar against the euro.

A:the current account balance and the interest in all investments. B:the current account balance and the non reserve portion of the financial account balance. C:the current account balance, the capital account balance, the non reserve portion of the financial account balance, the statistical discrepancy. D:the current account balance, the capital account balance, the non reserve portion of the financial account balance.

A:high and rising; expansionary fiscal policy B:high and rising; expansionary monetary policy C:zero or negative; expansionary fiscal policy D:high and rising; contractionary monetary policy

AI参考:正确答案是:B:high and rising; expansionary monetary policy 。因为“一经济处于流动性陷阱中”会使“名义利率升高并且上涨”因而货币有效刺激经济的政策应为扩张性的货币政策,选B。'

A:对 B:错

AI参考:正确答案是B:错。根据题目描述,第一代BOP危机理论认为基本面重要且危机不可预测,而第二代理论认为信念重要且危机可预测。但原文中的说法存在逻辑错误,即“the first generation theory of BOP crisis thinks fundamentals matter and the crisis is unpredictable”中的“fundamentals”和“unpredictable”相互矛盾。因此,题目描述的说法是错误的。'

A:对 B:错

A:对 B:错

A:错 B:对

AI参考:答案:B推理过程:投资回报率高的国家应该出现经常账户的赤字,投资回报率高说明其生产出的商品价值中出口大于进口,也就是说产品卖得比买得多,即出口大于进口必然会表现为经常账户的赤字。所以此题选择B项正确。解释:在做出选择时,不需要考虑国家或地区的发展状况或生产结构等,只需从常出现的投资或出口关系角度考虑即可。注:本题答案仅供参考,实际答案可能因具体情况而异。'

A:对 B:错

AI参考:答案是B:错。根据题干中的信息,美国在世界范围内拥有最负面的净外部财富,因此选项B是正确的。而选项A则与题干中的信息相反,因此是错误的。'

A:错 B:对

A:错 B:对

AI参考:正确答案是B:对。在汇率波动中,三角套利机会是指利用不同货币之间的汇率差异,同时买入高汇率货币,卖出低汇率货币,再买入另一种货币,从而获得收益的机会。为了判断是否存在三角套利机会,我们可以使用交叉汇率来帮助检查。因此,这个判断题的答案是B:对。'

A:错 B:对

A:对 B:错

AI参考:正确答案是【B:错】。本题为单选题,问题内容涉及外汇的升值和利率的影响,因此需要根据所学知识判断出该表述是不正确的。在通常情况下,外汇升值意味着货币汇率上升,这意味着本币贬值,因此美元存款利率上升不会导致美元升值。所以选项B“错”是正确的答案。'

A:对 B:错

AI参考:答案:B:错。外部正财富使一个国家成为债务国。这句话的意思是,一个国家拥有外部正财富时,它的财富会增长,但不一定是债务国。因此,这个判断题是错误的。'

AI参考:正确选项为: 德国和其邻近的欧洲国家在1990年东西德统一后,都受到了不同程度的影响。 德国方面的影响: 1. 政治稳定:统一后的德国政治环境更加稳定,减少了分裂带来的政治动荡和冲突。 2. 经济复苏:德国经济得到了加强,可以更有效地参与国际竞争,提高其国际地位。 欧洲邻国的影响: 1. 经济增长:统一后的德国成为欧洲最大的经济体之一,为欧洲其他国家提供了更多的贸易机会和投资机会。 2. 政治影响:统一后的德国在欧洲政治格局中的地位更加重要,对欧洲政治稳定和一体化进程产生了积极影响。 3. 安全保障:统一后的德国在欧洲安全问题上扮演了更加积极的角色,为欧洲安全提供了更多的保障。 需要注意的是,东西德统一对德国和欧洲邻国的影响是复杂而多方面的,不同国家、不同地区和不同行业可能受到的影响也不尽相同。因此,需要具体分析具体情况。"

AI参考:对于您的问题,我假设这是一个经济模型的问题,以下是对所给问题的回答: (a) 外部平衡的目标是使经常账户余额等于零或至少接近于零。换句话说,我们的目标是让X等于零或接近于零。 (b) 如果我们只考虑短期情况,那么P(国内价格水平)通常会等于P*(对应的外汇市场价格水平)。这是因为短期内货币数量和货币价值是恒定的。 (c) 如果E(外汇储备)上升,那么通常意味着我们的外汇储备增加,这通常表示我们的经济状况更好,因此我们可能会选择更宽松的货币政策(即降低P或P*)。 (d) 如果T(政府支出)下降,即实行扩张性财政政策,那么通常会导致P和P*下降,因为这通常意味着货币供应减少。 (e) 如果G(政府支出)增加,即实行扩张性财政政策,那么通常会导致P和P*上升,因为这通常意味着货币供应增加。 (f) 在上述所有条件都满足的情况下,我们可以看出E(外汇汇率)和财政宽松程度之间存在关系。更宽松的财政政策会导致E下降,更紧缩的财政政策会导致E上升。 (g) 如果政府保持当前账户在X上,但贬值了本国货币,那么通常会导致P和P*下降,因为这通常意味着货币供应减少。这可能会导致出口增加和进口减少,从而影响经常账户余额。 (h) 如果政府提高E(外汇汇率),那么通常会导致P和P*上升,因为这通常意味着货币供应增加。这可能会导致出口减少和进口增加,从而影响经常账户余额。 (i) 如果政府降低E(外汇汇率),那么通常会导致P和P*下降,因为这通常意味着货币供应减少。这可能会导致出口减少和进口增加,从而影响经常账户余额。然而,如果经济已经处于外部平衡状态,那么降低E可能不会对经常账户余额产生显著影响。 希望以上回答对您有所帮助!"

AI参考:正确选项为:Relative PPPs are useful when comparing countries that base their price levels on different product baskets because they allow for the comparison of values between countries that use different prices for the same goods and services. 解释:Relative PPPs(相对购买力平价)在比较那些基于不同产品篮子的国家时非常有用,因为它们允许对相同商品和服务在不同国家之间的价值进行比较。这可以通过一个例子来说明:假设两个国家A和B都生产相同的产品,但它们的价格体系不同。使用Relative PPP,我们可以将这两个国家的价格转换为相对的购买力平价,从而更好地比较这两个国家的经济状况。因此,Relative PPP在比较不同产品篮子的国家时非常有用。"

AI参考:正确选项为: B. 外汇市场供求平衡时的汇率水平 解释: 如果中央银行在产出增加时不购买外国资产,而是保持货币存量不变,那么它仍然可以通过保持外汇市场供求平衡来保持汇率固定在某个水平上。具体来说,中央银行可以通过调整货币供应量来影响外汇市场的供求关系,使其达到平衡状态。在这个平衡状态下,汇率就是固定在某个水平上的。 辅助图示: 假设外汇市场上有两个国家,A国和B国。A国货币与B国货币的汇率为e。中央银行保持货币存量不变,即货币供应量不变。如果A国货币供应量增加,那么外汇市场上A国货币的供给也会增加,而B国货币的供给不变。这将导致外汇市场上A国货币的汇率下降,即e变小。反之亦然。因此,中央银行可以通过调整货币供应量来影响外汇市场的供求关系,使其达到平衡状态,从而保持汇率固定在某个水平上。这个水平就是外汇市场供求平衡时的汇率水平。"

AI参考:在各种情况下的外汇汇率确定的过程中,可能会有许多种因素相互影响,而你提供的这四个因素都可能与汇率决定有直接或间接的关系。现在我会对每个情况进行分析,描述可能发生的链式事件: (a) 增加国内货币供应:当国内货币供应增加时,市场上的货币数量增加,这可能导致外汇市场上货币的购买力下降,从而引起汇率下降。同时,如果国内经济的其他方面没有受到影响,那么汇率的下降可能不会引发大规模的通货膨胀。 (b) 增加国际储备:如果一个国家的国际储备增加,这通常意味着该国能够购买更多的外币,或者在需要时兑换外币的能力增强。这种变化可能影响该国货币的价值,从而导致汇率的上升或下降。 (c) 世界相对需求增加:如果世界对某个国家的产品需求增加,那么该国货币的需求也会增加,这可能导致汇率上升。反之,如果需求下降,汇率可能会下降。 (d) 国内产出增长:如果国内产出增长,那么国内产品的供应会增加,这可能导致汇率下降。这是因为产出增长通常会引发物价上涨,这可能会导致货币的购买力下降。 至于选项 (d) 的描述并不明确。在现有的信息中并没有给出足够的信息来确定这种情况会如何影响汇率。我无法在这个上下文中对它进行具体的分析。 请注意,以上的分析是基于一般的经济理论。实际的经济情况可能会受到许多其他因素的影响,包括政策变动、市场情绪、贸易关系等。所以这些分析只是一种可能的路径,实际情况可能会有所不同。"

AI参考:正确答案是:B. The balance of payments account is improved. 根据题目中的描述,美国银行免除了阿根廷政府欠他们的两亿美元的债务,这会对美国的国际收支账户产生影响。而选项B表示“国际收支账户得到了改善”,与题目中的描述相符。因此,正确答案是B。"

AI参考:正确答案是:车辆货币指的是车辆本身所具有的价值。"

AI参考:An increase in the real exchange rate typically reduces imports and increases exports, as it makes domestic goods relatively more expensive compared to foreign goods. This is because the real exchange rate measures the relative prices of domestic and foreign goods, and an increase means that domestic goods become relatively more expensive. For exporters, this means that their products become more expensive relative to foreign competitors, which may encourage them to seek other markets or seek to increase their competitiveness through technological or cost-cutting measures. For importers, however, the increase in the real exchange rate makes foreign goods relatively cheaper, making it more attractive to purchase foreign goods instead of domestic ones. This can result in a decrease in imports and an increase in trade deficit, if the countrys imports exceed its exports. Therefore, an increase in the real exchange rate affects exports and imports through its impact on relative prices and market access."

AI参考:选项D:将货币稳定在一定水平上 解析: 问题问的是对于货币政策的长期均衡预期,所以需要理解货币政策的目标和预期。一般来说,货币政策的目标是保持货币稳定,而不是让货币增长过快或过慢。长期来看,政策制定者预期货币能够稳定在一定的水平上,而不会出现过多的波动。因此,选项D“将货币稳定在一定水平上”是最符合题意的答案。"

AI参考:答:这个问题需要考虑到宏观经济政策对其他国家的影响。由于这两个国家拥有不同的规模和政策体系,所以这个问题需要从不同的角度进行分析。 对于Home国家来说,如果实施积极的财政政策和宽松的货币政策,那么Home国家的货币将会升值,这将会导致Home国家出口商品的价格上升,从而影响Home国家的出口收入。同时,Home国家进口商品的价格将会下降,这将会降低Home国家的进口成本,从而增加Home国家的国内生产总值(GDP)。 对于Foreign国家来说,由于Home国家货币升值,Foreign国家货币贬值,这将会导致Foreign国家出口商品的价格下降,从而增加Foreign国家的出口收入。同时,由于Home国家货币升值,Foreign国家货币贬值,这也会导致Foreign国家进口商品的价格上升,从而增加Foreign国家的进口成本。 因此,Home国家的宏观经济政策对Foreign国家的影响是双重的。一方面,Home国家的出口收入增加,而另一方面,Foreign国家的进口成本增加。这取决于宏观经济政策的具体实施方式以及宏观经济政策对两个国家经济影响的程度。 总的来说,对于大国的宏观经济政策分析需要考虑到多种因素的综合影响,包括经济政策、国际市场、国内政治、人口变化等等。同时,也需要考虑到宏观经济政策可能产生的长期影响和短期效应之间的平衡。 正确选项为:Home国家的宏观经济政策对Foreign国家的影响是双重的。一方面,Home国家的出口收入增加,而另一方面,Foreign国家的进口成本增加。 以上答案仅供参考,建议根据实际情况进行分析和判断。"

AI参考:正确选项为: A. raise interest rates to prevent the exchange rate from appreciating 答案解释: 在生产增加的情况下,为了维持固定汇率,中央银行必须采取措施。由于生产增加意味着货币供应量增加,这可能导致汇率升值。为了防止汇率升值,中央银行通常会采取提高利率的措施,以抑制货币供应量的增长,从而稳定汇率。因此,答案A是正确的。"

AI参考:The PPP ( purchasing power parity ) theory predicts that the real exchange rates are determined by the relative amount of goods and services that each country can supply compared to the demand for them in each country. Therefore, it suggests that the exchange rate between two countries should be determined by the relative amount of goods and services that each country can produce, rather than by the current account or the capital account of each country. In other words, PPP theory predicts that the exchange rate between two countries should be stable over time, as long as the relative amount of goods and services that each country can produce remains unchanged."