第五章测试1.On September 5, the XYZ Co. made a $2,500 credit sale, due in 30 days. On October 1, the customer requested and was granted an extension on the payment. The customer was required to sign a 60-day, 5% note on the day of the extension. Payment was made on the maturity date of the note.

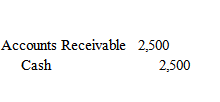

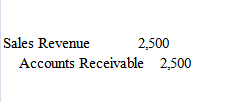

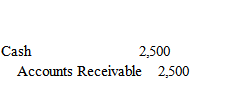

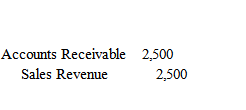

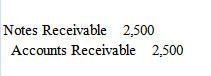

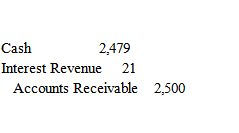

What is the entry on September 5 to record the credit sale?( )。

A:

B:

C:

D:

答案:D

2.Refer to Question 1. What is the maturity value of the note? (Round to the closest dollar)( )。

A:$2,521.00

B:$2,500.00

C:$2,625.00

D:$2,479.00

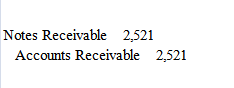

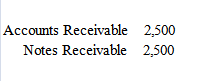

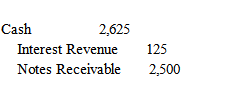

3.Refer to Question 1. What is the entry to record the extension on October 1?( )。

A:

B:

C:

D:

4.Refer to Question 1. What is the maturity date of the note?( )。

A:December 1

B:November 30

C:November 29

D:November 4

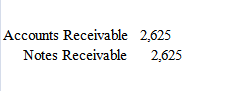

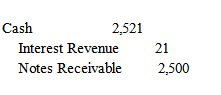

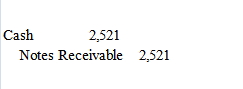

5.According to Question 1, What is the entry to record receipt of the payment, on the maturity date of the note?( )。

A:

B:

C:

D:

6.When an accounts receivable account has been determined to be uncollectible the entry to record the write off using the allowance method would include:( )。

A:A debit to Allowance for Uncollectible Accounts.

B:A credit to Notes Receivable.

C:A debit to Accounts Receivable.

D:A debit to Uncollectible Account Expense.

7.Which of the following about factoring a receivable is false?( )。

A:The seller receives the full value of the accounts receivable.

B:The seller receives the amount of the receivable less the financing expenses charged by the financial institution.

C:The seller loses control over the collection process.

D:Factoring is often expensive compared to the costs of retaining the receivable on the books.

8.

Available-for-sale securities are reported on the balance sheet at:( )。

A:Historical cost.

B:other three choices are not true.

C:Fair value.

D:Amortized cost.

9.

An unrealized gain occurs:( )。

A:If the sales price is greater than the investment carrying amount.

B:other three choices are not true.

C:If the fair value of the investment is greater than the current recorded value.

D:If the fair value of the investment is less than the current recorded value.

10.

Which method of writing off an uncollectible account does not violate the expense recognition principle?( )。

A:Both Direct write-off method and Allowance method B:Allowance method

C:Neither Direct write-off method or Allowance method D:Direct write-off method

温馨提示支付 ¥3.00 元后可查看付费内容,请先翻页预览!