第十五章测试1.

A monopolist is able to practice third degree price discrimination between two markets. The demand function in the first market is q = 500-2p and the demand function in the second market is q = 1500-6p. To maximize his profits, he should:

A:sell only in one of the two markets. B:charge a higher price in the second market than in the first. C:charge the same price in both markets. D:charge a higher price in the first market than in the second.

答案:C

2.

A monopolist sells in two markets. The demand curve for her product is given by p1 =119-2x1 in the first market and p2 = 123-5x2 in the second market, where xi is the quantity sold in Market i and pi is the price charged in Market i. She has a constant marginal cost of production, c = 3; and no fixed costs. She can charge different prices in the two markets. What is the profit-maximizing combination of quantities for this monopolist?

A:

x1 = 39 and x2 = 10

B:x1 = 58 and x2 = 14

C:x1 = 41 and x2 = 29

D:x1 = 29 and x2 = 12

3.A price-discriminating monopolist sells in two separate markets such that goods sold in one market are never resold in the other. It charges p1 = 3 in one market and p2 = 7 in the other market. At these prices, the price elasticity in the first market is-2:50 and the price elasticity in the second market is s0:80. Which of the following actions is sure to raise the monopolists profits?

A:

Lower p2.

B:Raise p1 and lower p2.

C:Raise both p1 and p2.

D:Raise p2.

4.A monopolist has a constant marginal cost of $2 per unit and no xed costs. He faces separate markets in the U.S. and England. He can set one price p1 for the American market and another price p2 for the English market. If demand in the U.S. is given by Q1 = 8,400-700p1,and demand in England is given by Q2 = 5,000-500p2; then the price in America will:

A:

be smaller than the price in England by 1.

B:be larger than the price in England by 3.

C:be larger than the price in England by 1.

D:equal the price in England.

5.Roach Motors has a monopoly on used cars in Enigma, Ohio. By installing secret microphones in the showroom, the friendly salespersons at Roach are able to learn each customer's willingness to pay and can therefore practice first degree price discrimination, extracting from each customer his entire consumer surplus. The inverse demand function for cars in Enigma is P = 2000-10Q. Roach Motors purchases its stock of used cars at an auction in Cleveland for $400 each. Roach motors will

A:

sell 160 cars at a price of $300 a car.

B:sell 192 cars and make a total profit of $20,4800.

C:sell 80 cars for a total profit of $64,000.

D:sell 160 cars for a total profit of $12,8000.

6.BMW (Bayerische Motoren Werk) charges a considerably higher price for its automobiles in the North American market than it does in its home market of Europe. Assuming that the goal of BMW's pricing policy is profit maximization, which of the following would be a plausible explanation for BMW's pricing policy?

A:

The price elasticity of demand is greater than 1 in both North America and Europe, making BMWs price elastic; but must be higher in Europe.

B:The income elasticity of demand in North America must be between 0 and 1, making BMWs a normal good in North America; and between and less than 1 in Europe, making BMWs an inferior good.

C:The price elasticity of demand in North America must be greater than 1, making demand for BMWs price elastic in North America; and between 0 and 1 in Europe, making demand for BMWs price inelastic.

D:The income elasticity of demand in North America must be greater than 1, making BMWs a luxury good in North America; and between 0 and 1 in Europe, making BMWs a normal good.

7.A monopolist finds that a person's demand for its product depends on the person's age. The inverse demand function of someone of age y; can be written p = A(y)-q where A(y) is an increasing function of y. The product cannot be resold from one buyer to another and the monopolist knows the ages of its consumers. If the monopolist maximizes its profits:

A:

everyone pays the same price but old people consume more.

B:older people will pay lower prices and purchase more of this product.

C:older people will pay higher prices and purchase more of this product.

D:older people will pay higher prices and purchase less of this product.

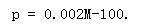

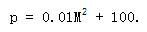

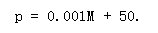

8.A monopolist has discovered that the inverse demand function of a person with income M for the monopolist's product is p = 0.002M-q. The monopolist is able to observe the incomes of its consumers and to practice price discrimination according to income (second-degree price discrimination). The monopolist has a total cost function, c(q) = 100q. The price it will charge a consumer depends on the consumer's income, M; according to the formula:

A:

Wobble's Weebles is the only producer of weebles. It makes weebles at constant marginal cost c (where c > 0) and sells them at a price of p1 per weeble in Market 1 and at a price of p2 per weeble in Market 2. The demand curve for weebles in Market 1 has a constant price elasticity of demand equal to -2. The demand curve for weebles in Market 2 has a constant price elasticity equal to -3/2. The ratio of the profit maximizing price in Market 1 to the profit maximizing price in Market 2 is:

A:

3/2

B:3

C:2/3

D:1/3

10.A monopolist sells in two markets. The demand curve for her product is given by p1 = 303-3*x1 in the first market and p2 = 253-5*x2 in the second market, where xi is the quantity sold in Market i and pi is the price charged in Market i. She has a constant marginal cost of production, c = 3; and no fixed costs. She can charge different prices in the two markets. What is the profit-maximizing combination of quantities for this monopolist?

A:

x1 = 100 and x2 = 27

B:x1 = 50 and x2 = 25

C:x1 = 75 and x2 = 50

D:x1 = 60 and x2 = 23