提示:内容已经过期谨慎付费,点击上方查看最新答案

金融风险管理

- An Italian bank enters into a 6-month forward contract with an importer to sell GBP 80 million in 6 months at a rate of EUR 1.13 per GBP 1. If in 6 months the exchange rate is EUR 1.12 per GBP 1, what is the payoff to the bank from the forward contract?( )

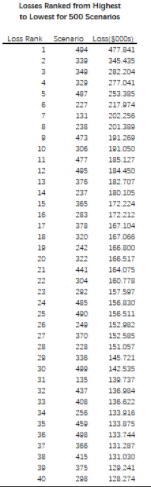

- Suppose that GARCH(1,1) parameters have been estimated asω=0.000003, α=0.04, and β=0.94. The current daily volatility is estimated to be 1%. Estimate the daily volatility in 30 days.( )

- Assume that a portfolio underperformed its benchmark by 2% in the most recent month. In this scenario,( )

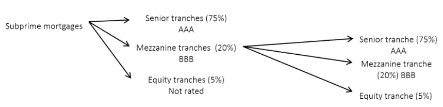

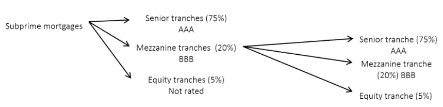

- Suppose the ABSs and ABS CDO structure is just like the right table. Which of the following losses to tranches is correct?

( )

( ) - A portfolio of stock E and options on stock E is currently delta neutral, but has a positive gamma. Which of the following actions will make the portfolio with both delta and gamma neutral?( )

- Imagine a portfolio which holds two binary options, each with the same payoff and probability: $-100 with a probability of 4% and $ 0 with a 96% probability. Assuming the underlying has uncorrelated returns, what is the VaR (95% confidence level, 1-day)?( )

- In evaluating the dynamic delta hedging of a portfolio of short positions, which of the following is correct?( )

- A trader enters into a short cotton futures contract when the futures price is 50 cents per pound. The contract is for the delivery of 50,000 pounds. How much does the trader gain or lose if the cotton price at the end of the contract is 48.20 cents per pound.( )

- A five-year bond with a yield of 11% (continuously compounded) pays an 8% coupon at the end of each year. Calculate the bond's duration?( )

An ABS CDO is an ABS generally created from AAA-rated tranches of a number of different ABSs.

- A fund manager announces that the fund's three-month 90% VaR is 6% of the size of the portfolio being managed. You have an investment of $10,000 in the fund. Which of the following options interpret the portfolio manager's announcement best?( )

- The parameters of a GARCH(1,1) model are estimated as ω=0.000004, α=0.05, and β=0.92. If the current volatility is 20% per year, what is the expected volatility in 20 days?( )

( )

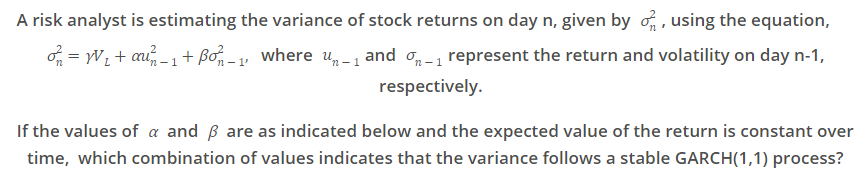

( ) - Suppose the ABSs and ABS CDO structure is just like the right table. If the loss rate on the mortgages is 12%, what is the loss rate on the senior tranche of the ABS CDO?

( )

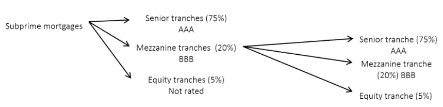

( ) - The losses for the four-index example is the following table. What is the 95% one-day VaR (500 scenario)?

( )

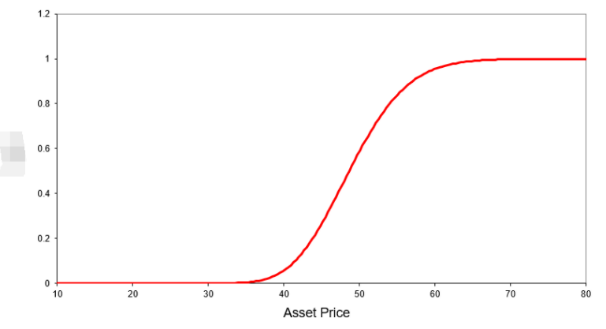

( ) - The graph shows a relationship between one of the Greeks of a long position of an European call option and the stock price. Can you guess which of the following Greeks is for the y-axis?

( )

( ) - Suppose that each of two investments has a 4% chance of a loss of $10 million, a 2% chance of a loss of $1 million, and a 94% chance of a profit of $1 million. They are independent of each other. Calculate the VaR for one of the investments when the confidence level is 95%?( )

- Capital is used to protect the bank from which of the following risks:( )

- Which formula describe the CAPM?( )

- Assume that an index at close of trading yesterday was 1,040 and the daily volatility of the index was estimated as 1% per day at that time. The parameters in a GARCH(1,1) model are ω=0.000002, α=0.06, and β=0.92. If the level of the index at close of trading today is 1,060, what is the new volatility estimate?( )

- Which of the following table reflects the evolving of structure of banking in US between during the last 30 years?( )

- A portfolio of stock XYZ and options on stock XYZ is currently delta neutral, but has a positive gamma. Which of the following actions will make the portfolio with both delta and gamma neutral?( )

- Portfolio A consists of a one-year zero-coupon bond with a face value of $2,000 and a 10-year zero-coupon bond with a face value of $6,000. The current yield on all bonds is 10% per annum (continuously compounded). What is the duration of portfolio A?( )

- Good years are followed by equally bad years for a mutual fund. It earns +8%, -8%, +12%, -12% in successive years. What is the investor's overall return for the four years?( )

- Which of the following IBM options has the highest gamma with the current market price of IBM common stock at $68?( )

- Suppose the S&P 500 Index has an expected annual return of 7.2% and volatility of 8.2%. Suppose XXX Fund has an expected annual return of 6.8% and volatility of 7.0% and is benchmarked against the S&P 500 Index. According to the CAPM, if the risk-free rate is 3.2% per year, what is the beta of the XXX Fund?( )

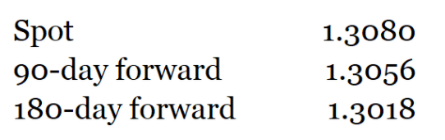

- Suppose that USD-sterling spot and forward exchange rates are in the right table, what opportunities are open to an arbitrageur if a 90-day European put option to sell £1 for $1.34 costs 2 cents.

( )

( ) - Suppose the ABSs and ABS CDO structure is just like the table shown below. If the loss rate on the mortgages is 10.5%, what is the loss rate on the mezzanine tranche of the ABS CDO?

( )

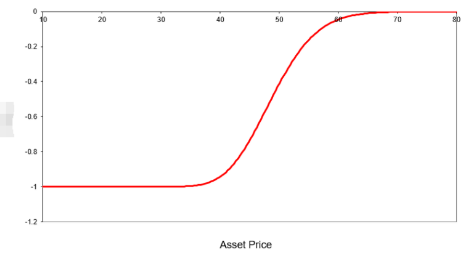

( ) - The graph shows the relationship between one of the Greeks of a long position of an European put option and the stock price. Can you guess which of the following Greeks is for the y-axis?

( )

( ) - The volatility of an asset is 2% per day. What is the standard deviation of the percentage price change in 5 days?( )

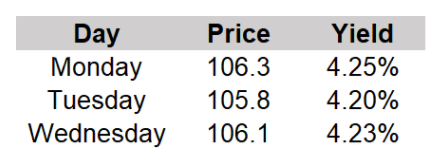

- The following table provides the closing prices and yields of a particular liquid bond over the past few days. Use the information from the table to approximate duration of the bond.

( )

( ) - The rating agencies have analyzed the creditworthiness of Company XYZ and have determined that the company currently has adequate payment capacity, although a negative change in the business environment could affect its capacity for repayment. The company has been given an investment grade rating by S&P and Moody's. Which of the following S&P/Moody's ratings has Company XYZ been assigned?( )

- The expected return on the market portfolio is 12% and the risk-free rate is 6%. What is the expected return on an investment with a beta of 0.2?( )

- Which of the following descriptions are not the assumption for CAPM?( )

- Which of the following descriptions are correct about long/short strategies?( )

- Which of the following descriptions are correct about global macro strategies?( )

- An ABS CDO is created from tranches of ABSs. A motivation on the part of the originator was that it could be difficult to find investors for the tranches directly.( )

- Duration provides information about the effect of a large parallel shift in the yield curve on the value of a bond portfolio.( )

- Dedicated short strategy usually looks for overvalued companies and sell them short.( )

- It is important for a hedge fund to be right in the long term. Short-term gains and losses do not matter.( )

- Net interest income on the income statement of a bank is associated with market risk.( )

- An ABS CDO is an ABS generally created from AAA-rated tranches of a number of different ABSs.( )

- Non-interest expense on the income statement of a bank is associated with credit risk.( )

When a trader enters into a short forward contract, he is agreeing to buy the underlying asset for a certain price at a certain time in the future.

The risks in ABS CDOs were often misjudged by the market. Because investors who underestimated the default correlations between mortgages would be suffered higher loss in stressed market conditions.

- Duration is a measure of how long the bond holder has to wait for receiving cash flows.( )

- The risks in the tranche of an ABS are different from the risks in a similarly rated bond. Often a tranche is thin and the probability distribution of the loss is quite different from that on the bond. If a loss occurs, there is a high probability that it will be 100%. A 100% loss is much less likely for a bond.( )

- Emerging markets strategy generally specializes in investments associated with developed countries’ equity and debt.( )

- GARCH(1,1) is generally consistent with a mean-reverting variance rate model.( )

- When a trader enters into a short forward contract, he is agreeing to buy the underlying asset for a certain price at a certain time in the future.( )

A:EUR 400,000 B:EUR -400,000 C:EUR 800,000 D:EUR -800,000

答案:EUR800,000

A:2.20% B:1.11% C:0.0012%

答案:RCH(1,1)parameters have been estimated asω=0

A:alpha is 2% B:due to underperformance, alpha is definitely negative and cannot be positive C:alpha is "-2%" as it refers to the outperformance/underperformance Gap D:alpha may be positive or negative depending upon beta and risk free rate

答案:/underperformance Gap

A: B: C:

答案:100%

A:Buy call options on stock E and sell stock E B:Buy put options on stock E and buy stock E C:Sell put options on stock E and sell stock E D:Sell call options on stock E and sell stock E

答案:Sell put options on stock A and sell stock A

A:The VaR is $100 B:The VaR is zero C:None of the above D:The VaR is $200

A:The interest cost of carrying the delta hedge will be highest when the options are deep out-of-the-money. B:The interest cost of carrying the delta hedge will be highest when the options are deep in-the-money. C:The interest cost of carrying the delta hedge will be highest when the options are at-the-money. D:The interest cost of carrying the delta hedge will be lowest when the options are at-the-money.

A:-$900 B:$900 C:$200

A:4.256 B:3.982 C:4.536

A:CDO ABS B:ABS C:CDO D:ABS CDO

AI参考:正确选项是:D:ABS CDO。根据题目中的描述,ABS CDO通常是由许多不同ABS的AAA评级部分创建的ABS。根据选项,D选项包含了ABS CDO的全部信息,因此是正确答案。A、B、C选项都只包含了部分信息,因此不是正确答案。'

A:There is a 10% chance that you are expected to lose $600 during a three-month period. B:There is a 10% chance that you will lose $600 or more during a three-month period. C:There is a 10% chance that you will lose $600 at most during a three-month period.

A:1.21% B:1.44% C:2.55%

A:α=0.075637, and β=0.923363 B:α=0.086637, and β=0.914363 C:α=0.084637, and β=0.916363 D:α=0.073637, and β=0.927363

AI参考:通过对题目给出的信息进行分析,我们可以得到答案为:“Alpha” 是不确定度的一种表现形式,A,C两个选项在 α 方面有所偏差。Beta 代表置信度,从B,D两个选项的 β 中看出有一定差异。Alpha 用于度量实验因素的主效应,而 Beta 考虑了其他可能影响因变量的变量对因变量的影响。Beta 的数值大于1一般被认为会增强不确定性,所以在综合考虑两个值时,选择C:α=0.084637, and β=0.916363。因此,正确答案是C:α=0.084637, and β=0.916363。'

A:5% B:13.33% C:10%

AI参考:根据图中的信息,ABSs和ABS CDO结构就像一个金字塔,ABS CDO的高级档位于金字塔的顶部,它承受的是所有底层贷款池损失的最大集合。在这个结构中,如果抵押贷款的损失率为12%,那么ABS CDO高级档的损失率将是底层贷款池损失率(12%)加上对底层损失的再次吸收(通常是3%到7%),但题目中并没有给出再次吸收的具体比例,因此高级档的损失率需要进一步假设。然而,我们知道这个再吸收的比例对于损失率的影响是非常小的,因此我们可以在这里忽略这个影响。基于以上的分析,我们可以假设高级档的损失率与底层损失率相同,即12%。所以,正确答案是C:10%。'

A:$156.511 B:$166.517 C:$142.535

AI参考:通过图片数据可知,单日的95%置信度的VaR(500个情景)为:$142.535。因此,答案是C:$142.535。'

A:rho B:delta C:gamma D:vega

AI参考:通过对题目图片的分析,可以看出这是一个关于欧式期权头寸的希腊字母和股票价格之间的关系图。希腊字母是用来衡量期权风险的重要指标,而股票价格是横轴。根据图片中的关系,可以猜测在纵轴上可能表示的是风险程度较高的希腊字母,而根据希腊字母的含义,rho、delta、gamma和vita都可能符合要求。然而,题目中明确提到了“不需要分析”,因此我们不能深入分析这些希腊字母的含义和特点。所以,直接根据题目描述和图片关系,我们可以得出结论:纵轴应该表示的是风险程度较高的希腊字母,因此选项C:gamma是正确答案。'

A:$8.2 million B:$10 million C:$1 million

A:Low frequency risks with significant severe financial impact. B:High frequency uncorrelated events. C:Risks with an extreme catastrophic financial impact. D:High frequency low loss events.

A: B: C:

A:2.012% B:1.355% C:1.078%

AI参考:从题目给出的信息中,我们知道昨天收盘时的指数为1,040,当时该指数的每日波动性估计为1%。GARCH(1,1)模型的参数为:ω=0.000002,α=0.06,β=0.92。而题目要求根据今天收盘时指数为1,060的情况下,估算新的波动性。根据GARCH模型,新的波动性可以由以下公式计算:新波动性 = (原来的波动性 + 预期的未来波动性变化)预期的未来波动性变化 = α * 过去的波动性平方 + β * 过去的波动性平均值在这个问题中,我们已知过去的波动性平方为零(因为假设过去的数据都是零),且过去波动性的平均值为(ω/α + β)/β = (0.000002/0.06 + 0.92)/0.92 = 1.49%所以预期的未来波动性变化 = 0.06 * 1.49% = 0.00894%因此,新的波动性估计为:原来的波动性 + 预期的未来波动性变化 = 1% + 0.00894% = 1.0784%所以答案是C:1.078%。'

A: B: C:

A:Buy call options on stock XYZ and sell stock XYZ B:Buy put options on stock XYZ and buy stock XYZ C:Sell put options on stock XYZ and sell stock XYZ D:Sell call options on stock XYZ and sell stock XYZ

A:5.50 B:5.95 C:6.50

AI参考:根据题目描述,Portfolio A由一张面值为2000美元的一年期零息债券和一张面值为6000美元的10年期零息债券组成。所有债券的年化当前收益率为10%(连续复利)。为了回答这个问题,我们需要计算Portfolio A的久期。久期是衡量债券价格对利率变动敏感度的指标,通常通过将债券的收益率曲线平移来计算。在这个问题中,由于我们不知道债券的具体息票率和利率,所以我们无法直接使用债券的到期收益率来计算久期。然而,我们可以使用一些替代方法来估算久期。一种常见的方法是使用收益率的简单移动平均值来估算久期。在这种情况下,我们可以假设收益率曲线是平的,并且所有债券的收益率都在当前收益率的基础上增加了相同的百分比。在这种情况下,Portfolio A的久期大约为6.5年(假设所有债券的收益率增加了10%)。这个数值与选项C匹配,因此答案是C:6.50。所以,正确答案是C:6.50。'

A:0% B:2.2% C:-2.07% D:0.5%

AI参考:C: -2.07%。\r题目中描述了好年之后同样糟糕的年对共同基金的影响。经过连续四年的投资收益+8%,-8%,+12%,-12%,因此,投资者的整体回报率是在这四年中的平均收益率是-(8%+(-8%)+12%+(-12%))/4= -2.07%。所以,正确选项为C:-2.07%。'

A:Call option expiring in 10 days with strike $70 B:Put option expiring in 10 days with strike $50 C:Put option expiring in 2 months with strike $70 D:Call option expiring in 10 days with strike $50

AI参考:正确答案是D:Call option expiring in 10 days with strike $50。Gamma反映的是期权价格对标的资产价格的变动率,如果当前IBM股票价格为$68,则离到期日最近的$50美元看涨期权gamma最高,因为到到期日还有10天,标的资产价格还有可能上涨,所以对上涨的敏感度最高。因此选项D是正确的。其他选项中,选项A和B是看跌期权,选项C是两个月后到期的看涨期权,这些期权的价格对标的资产价格的变动率敏感度相对较低。因此,选项D是唯一一个具有最高gamma的选项。'

A:1.23 B:0.90 C:0.20 D:0.92

A:The trader buys 90-day put options and takes a long position in a 90-day forward contract. B:The trader buys 90-day put options and takes a long position in a 180-day forward contract. C:The trader short 90-day put options and takes a short position in a 90-day forward contract.

A:100% B:0% C:20%

A:delta B:rho C:vega D:gamma

A:4.47% B:2.52% C:3.46%

A:9.4 B:1.9 C:18.8

AI参考:答案为C:18.8根据表格信息,债券的最近几天的收盘价和收益率都呈现逐渐上升的趋势,结合债券价格与期限的关系,可以推断出该债券的期限较长,因此选项C“18.8”为正确答案。需要注意的是,债券的期限通常是根据债券的票面利率、市场利率、付息频率等因素来确定的,需要结合实际情况进行具体分析。'

A:BBB/Baa B:A/A C:BB/Ba D:AA/Aa

A:7.2% B:9.4% C:5.0%

AI参考:从题目中我们知道,市场投资组合的预期收益率为12%,无风险利率为6%。另外,投资对象的贝塔系数是0.2。贝塔系数用来衡量一种投资对市场波动的敏感度。根据投资理论,预期收益率 = 市场收益率 + 贝塔系数的贡献。因此,我们可以通过上述信息来推算投资组合的预期收益率。对于贝塔系数为0.2的投资,预期收益率 = 12% + 0.2 * (12% - 6%) = 9.4%。所以,答案是B:9.4%。'

A:Involves taking long and short positions in equity and equity derivative securities. B:An dollar-neutral fund is one of the long/short strategies hedge funds. C:Long/short funds tend to invest primarily in publicly traded equity and their derivatives, and tend to be short biased.

A:Global macro funds are not confined to any specific investment vehicle or asset class, and can include investment in equity, debt, commodities, futures, currencies, real estate and other assets in various countries. B:Global macro refers to the general investment strategy making investment decisions based on broad political and economic outlooks of various countries. C:Global macro strategy involves both directional analysis, which seeks to predict the rise or decline of a country’s economy, as well as relative analysis, evaluating economic trends relative to each other.

A:错 B:对

AI参考:答案是B:对。根据题目中的描述,ABS CDO是由ABS的分档证券(tranches)构成的。发起人创建ABS CDO的动机之一可能是直接寻找投资者来购买分档证券可能会很困难。因此,选项B“对”是正确的答案。选项A“错”与此描述不符。'

A:对 B:错

AI参考:正确答案是A:对。Duration提供了关于收益率曲线大幅平行移动对债券投资组合价值影响的信息。Duration用来衡量债券价格对利率变动敏感度的一个指标,当收益率曲线发生大幅平行移动时,会对债券投资组合的价值产生影响。因此,这个说法是正确的。'

A:对 B:错

A:错 B:对

AI参考:B:对。根据题目中的句子“It is important for a hedge fund to be right in the long term. Short-term gains and losses do not matter.”可以得知,对对冲基金来说,长期来看正确是非常重要的,而短期收益和损失并不重要。因此,答案是B:对。'

A:对 B:错

A:错 B:对

AI参考:正确答案是B:对。ABS CDO是一种ABS,通常是由一系列不同ABS的AAA评级的分层证券所组成的。因此,该判断题表述正确。'

A:错 B:对

A:对 B:错

A:对 B:错

A:对 B:错

A:错 B:对

AI参考:B:对。ABS证券的批次风险与同等级别的债券风险不同。批次通常很薄,损失的概率分布与债券的分布有很大不同。如果发生损失,很可能会达到100%。但对于债券来说,出现100%损失的可能性要小得多。因此,本题选择B:对。'

A:错 B:对

AI参考:正确答案是B:对。新兴市场策略通常专注于与发达国家股票和债券相关的投资。因此,这个判断题的答案是B,即“对”。'

A:错 B:对

AI参考:正确答案是B:对。GARCH(1,1)模型是一种广义自回归条件异方差模型,它通常与均值回溯方差率模型相一致。因此,该判断题是正确的。'

A:错 B:对

温馨提示支付 ¥1.70 元后可查看付费内容,请先翻页预览!