上海杉达学院

第一章单元测试

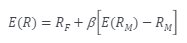

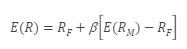

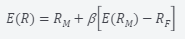

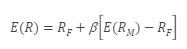

- Which formula describe the Capital Asset Pricing Model?( )

- Which of the following descriptions are the assumption for Capital Asset Pricing Model?( )

- The return from the market last year was 10% and the risk-free rate was 5%. A hedge fund manager with a beta of 0.6 has an alpha of 4%. What return did the hedge fund manager earn?( )

- Suppose the S&P 500 Index has an expected annual return of 7.2% and volatility of 8.2%. Suppose Andromeda Fund has an expected annual return of 6.8% and volatility of 7.0% and is benchmarked against the S&P 500 Index. According to the CAPM, if the risk-free rate is 2.2% per year, what is the beta of the Andromeda Fund?( )

- If a bond issued by a company have a rating of AAA, the company generally can not be referred to as having a rating of AA.( )

A:

B:

C:

答案:

A:Investors care only about expected return and standard deviation of return.

B:Tax does not influence investment decisions.

C:All investors make the same estimates of

.

.D:The

's of different investments are independent.

's of different investments are independent.E:All investors can borrow or lend at the same risk-free rate.

F:Investors focus on returns over one period.

答案:Investors care only about expected return and standard deviation of return.

###Tax does not influence investment decisions.

###All investors make the same estimates of

.

.###The

's of different investments are independent.

's of different investments are independent.###All investors can borrow or lend at the same risk-free rate.

###Investors focus on returns over one period.

A:0.15

B:0.12

C:0.10

答案:0.12

A:0.92

B:0.90

C:1.23

D:0.20

答案:0.92

A:对 B:错

答案:对

温馨提示支付 ¥3.00 元后可查看付费内容,请先翻页预览!