第六章单元测试

- Suppose the delta of a call option is 0.7. How can a short position in 1,000 options be made delta neutral?( )

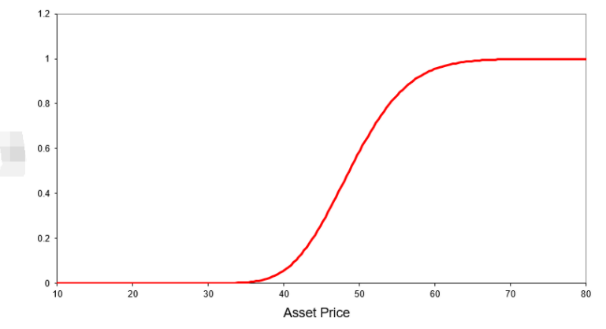

- The graph shows the relationship between one of the Greeks of a long position of an European call option and the stock price. Can you guess which of the following Greeks is for the y-axis?

( )

( ) - The gamma of a delta-neutral portfolio is 30. Estimate what happens to the value of the portfolio when the price of the underlying asset suddenly decreases by $2.( )

- A portfolio of stock A and options on stock A is currently delta neutral, but has a positive gamma. Which of the following actions will make the portfolio with both delta and gamma neutral?( )

- Which of the following statements is true regarding options' Greeks?( )

A:Short 700 shares.

B:Purchase 1,000 shares.

C:Purchase 700 shares.

答案:Purchase 700 shares.

A:gamma

B:delta

C:vega

A:The value of the portfolio increases by $60.

B:The value of the portfolio increases by $120.

C:The value of the portfolio decreases by $60.

A:Sell call options on stock A and sell stock A

B:Sell put options on stock A and sell stock A

C:Buy put options on stock A and buy stock A

D:Buy call options on stock A and sell stock A

A:Delta of deep in-the-money put options tends towards +1.

B:Gamma is greatest for in-the-money options with long times remaining to expiration.

C:Theta tends to be large and positive for at-the-money options.

D:Vega is greatest for at-the-money options with long times remaining to expiration.

温馨提示支付 ¥3.00 元后可查看付费内容,请先翻页预览!