第七章单元测试

- A five-year bond with a yield of 11% (continuously compounded) pays an 8% coupon at the end of each year. What is the bond's duration?( )

- A trading portfolio consists of two bonds, A1and B1. Both have modified duration of 3 years and face value of $1,000. Bond A1 is a zero-coupon bond, and its current price is $900. Bond B1pays annual coupons and is priced at par. What is expected to happen to the market prices of bond A1and bond B1, in dollar terms, if there is a parallel upward shift in the yield curve of 1%?( )

- Duration is a measure of how long the bond holder has to wait for cash flows.( )

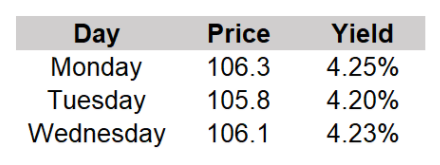

- The table gives the closing prices and yields of a particular liquid bond over the past few days. What is the approximate duration of the bond?

( )

( ) - Modified duration is used when the yield y is expressed with compounding m times per year.( )

A:4.536

B:3.982

C:4.256

答案:4.256

A:Both bond prices will move down by roughly equal amounts.

B:Both bond prices will move up, but bond B1 will gain more than bond A1.

C:Both bond prices will move down, but bond B1 will lose more than bond A1.

A:对 B:错

A:9.4

B:18.8

C:1.9

A:对 B:错

温馨提示支付 ¥3.00 元后可查看付费内容,请先翻页预览!