第九章单元测试

- A fund manager announces that the fund's one-month 95% VaR is 6% of the size of the portfolio being managed. You have an investment of $100,000 in the fund. Which of the following options interpret the portfolio manager's announcement best?( )

- Suppose that each of two investments has a 0.9% chance of a loss of $10 million and a 99.1% chance of a loss of $1 million. The investments are independent of each other. What is the VaR for one of the investments when the confidence level is 99%?( )

- Suppose that each of two investments has a 4% chance of a loss of $10 million, a 2% chance of a loss of $1 million, and a 94% chance of a profit of $1 million. They are independent of each other. What is the VaR for one of the investments when the confidence level is 95%?( )

- If the daily, 90% confidence level, VaR of a portfolio is correctly estimated to be $5,000, one would expect that in one out of:( )

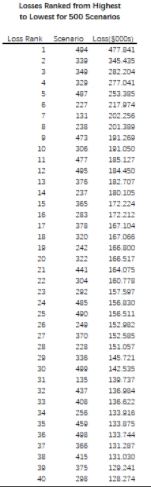

- The losses for the four-index example is the right table. What is the 95% one-day VaR (500 scenario)?

( )

( )

A:There is a 5% chance that you will lose $6,000 or more during a one-month period.

B:There is a 5% chance that you are expected to lose $6,000 during a one-month period.

C:There is a 5% chance that you will lose $6,000 at most during a one-month period.

答案:There is a 5% chance that you will lose $6,000 or more during a one-month period.

A:$10 million

B:$9.1 million

C:$1 million

A:$10 million

B:$8.2 million

C:$1 million

A:90 days, the portfolio value will decline by $5,000 or less

B:10 days, the portfolio value will decline by $5,000 or more

C:10 days, the portfolio value will decline by $5,000 or less

A:$166.517

B:$142.535

C:$156.511

温馨提示支付 ¥3.00 元后可查看付费内容,请先翻页预览!