兰州理工大学

- Barney Co expected to produce 200 units of its product, the Bone, in 20X3. In fact 260 units were produced. The standard labour cost per unit was $70 (10 hours at a rate of $7 per hour). The actual labour cost was $18,600 and the labour force worked 2,200 hours although they were paid for 2,300 hours. The direct labour rate variance for Barney Co in 20X3 was $3,200 (Adverse) ( ) Barney Co预计将在20X3年生产200单位的产品Bone。实际上生产了260台。每单位的标准人工成本为70美元(10个小时,每小时为7美元)。实际的劳动力成本为18,600美元,尽管工作了2,200个小时,但按2,300个小时支付了劳动报酬。Barney Co在20X3年的直接人工工资率差异为$ 3,200(不利)。 ( )

- When opening inventories were 8,500 litres and closing inventories 6,750 litres, a firm had a profit of $27,400 using marginal costing. Assuming that the fixed overhead absorption rate was $2 per litre, the profit using absorption costing would be $23,900 ( )当期初库存为8,500升和期末库存为6,750升时,采用边际成本计算法,公司的利润为27,400美元。假设固定的间接费用分配率为每升2美元,则使用吸收成本法计算的利润为23 900美元 ( )

- The primary users of the financial accounting information is external users, such as creditors, stockholders, and government regulators. ( )财务会计信息的主要用户是外部用户,如债权人、股东和政府监管机构。( )

- R Co uses a standard costing system. The budget for one of its products for September includes direct labour cost (based on 4 hours per unit) of $117,600. During September 3,350 units were made which was 150 units less than budgeted. The direct labour cost incurred was $111,850 and the number of direct labour hours worked was 13,450. The direct labour efficiency variance for the month was $420.00 (favorable) ( ) R Co使用标准成本核算系统。9月份,一种产品的预算直接人工成本为(基于每单位4个小时)117,600美元。在9月,制造了3,350个单位,比预算少150个单位。产生的直接人工成本为111,850美元,直接人工小时数为13,450。 该月的直接人工效率差异为$ 420.00(有利)。( )

- Zero-Based Budgeting is a budgeting approach in which managers begin with a budget of zero and must justify every dollar put into the budget. ( )零基预算是一种预算编制方法,其中管理人员从零预算开始,必须证明投入预算的每一美元都是正当的。( )

- Period Costs are costs incurred by the company to operate the business that do not get treated as inventory, but rather are expensed immediately in the period in which they are incurred. ( )期间成本是公司为经营业务而发生的成本,这些业务不被视为库存,而是立即在发生这些业务期间内费用化。 ( )

- The internal rate of return for a project can be determined only if the project cash flows are constant. ( )只有在项目现金流量不变时,才能确定项目的内部回报率。( )

- The operations to produce a unit of product L require 9 active hours. Budgeted idle time of 10% of total hours paid for is to be incorporated into the standard times for all products. The wage rate is $4 per hour. The standard labour cost of one unit of product L is $40.00 ( )生产单位产品L的实际需要9个小时。 所有产品的标准时间中包含已支付总小时数的10%的预算空闲时间。 工资率为每小时$ 4。 一件产品L的标准人工成本为$ 40.00。 ( )

- One of the payback method’s significant weaknesses is that it disregards the time value of money. Weighting all cash inflows equally ignores the fact that money has a cost. ( )投资回收期法的一个重大弱点是它忽视了金钱的时间价值。权衡所有现金流入同样忽略了一个事实,即货币是有成本的。 ( )

- A plan that is created using budgeted revenue and costs but is based on the actual units of output is known as a Flexible budget. ( )基于实际的的产出量水平确定的预算收入和成本,称为弹性预算。 ( )

- Period costs do not relate to manufacturing or purchasing product, and are often called operating expenses or selling, general, and administrative expenses. ( )期间成本与制造或采购产品无关,通常称为运营费用或销售、一般和管理费用。( )

- A favorable materials price variance coupled with an unfavorable materials usage variance most likely results from the purchase and use of higher-than-standard quality materials. ( )有利的材料价格差异加上不利的材料用量差异很可能是购买和使用高于标准的质量材料的结果。 ( )

- The following information is available for SM Co for last month: Conversion costs $105,280; Completed during the period 18,000 units; Closing work in progress 2,000 units (40% complete as to conversion costs). The conversion cost per unit of production was $5.60( )以下是SM公司上个月的可用信息:转换成本$ 105,280; 在此期间产成品为18,000单位; 期末在产品2,000个单位(转换成本的完工率为40%)。 每生产单位的转换成本为5.60美元。( )

- Practical Standards are standards based on perfect or ideal conditions that do not allow for any waste in the production process, machine breakdown, or other inefficiencies. Also known as ideal standards. ( )实践标准是基于完美或理想条件的标准,不允许在生产过程中产生任何浪费、机器故障或其他低效。也称为理想标准。 ( )

- Depreciation on production equipment is a Part of production overheads. ( )生产设备的折旧是生产间接费用的一部分。( )

- Barney Co expected to produce 200 units of its product, the Bone, in 20X3. In fact 260 units were produced. The standard labour cost per unit was $70 (10 hours at a rate of $7 per hour). The actual labour cost was $18,600 and the labour force worked 2,200 hours although they were paid for 2,300 hours. The direct labour rate variance for Barney Co in 20X3 was $400 (Adverse) ( )Barney Co预计将在20X3年生产200单位的产品Bone。实际上生产了260台。每单位的标准人工成本为70美元(10个小时,每小时为7美元)。实际的劳动力成本为18,600美元,尽管工作了2,200个小时,但按2,300个小时支付了劳动报酬。Barney Co在20X3年的直接人工工资率差异为$ 400(不利)。 ( )

- Committed Fixed Costs are fixed costs that are a result of annual management decisions,and are controllable in the short run. ( )约束性固定成本是年度管理决策的结果,短期内是可控的。 ( )

- An ideal standard is a standard which includes no allowance for losses, waste and inefficiencies. It represents the level of performance which is attainable under perfect operating conditions ( )理想标准是不包括损失,浪费和效率低下的标准。 它代表了在理想的操作条件下可以达到的性能水平。( )

- R Co uses a standard costing system. The budget for one of its products for September includes direct labour cost (based on 4 hours per unit) of $117,600. During September 3,350 units were made which was 150 units less than budgeted. The direct labour cost incurred was $111,850 and the number of direct labour hours worked was 13,450. The direct labour rate variance for the month was $710 (Favorable) ( )R Co使用标准成本核算系统。9月份,一种产品的预算直接人工成本为(基于每单位4个小时)117,600美元。在9月,制造了3,350个单位,比预算少150个单位。产生的直接人工成本为111,850美元,直接人工小时数为13,450。 该月的直接人工工资率差异为710美元(有利)。 ( )

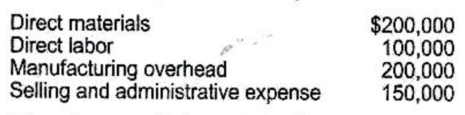

- Butteco has the following cost components for 100,000 units of product for the year:

Buteco 的100,000 台产品的成本构成如下:

All costs are variable except for $100,000 of manufacturing overhead and $100,000 of selling and administrative expenses. The total costs to produce and sell 110,000 units for the year are $695,000 ( )

除 100,000 美元的制造间接费用和 100,000 美元的销售和管理费用外,所有成本都是可变的。全年 11 万台的生产和销售总成本为 695,000 美元( ) - Which of the following statements are not true regarding absorption costing and variable costing? ( ) 以下关于吸收成本法和可变成本法的陈述中,哪些不正确?( )

- Which of the following are parts of manufacturing overhead? ( ) 以下哪些是制造费用的一部分? ( )

- Which of the following are activities in the value chain? ( ) 以下哪一项是价值链中的活动? ( )

- Inventoriable costs ( )存货成本是指 ( )

- Advantages of using standard costs and variances include( ) 使用标准成本和差异的优势包括 ( )

- Which of the following are parts of manufacturing overhead? ( ) 以下哪些是制造费用的一部分?( )

- “Number of new products developed” would NOT be a key performance indicator (KPI) for which of the four balanced scorecard perspectives? ( ) “开发的新产品数量”将不是四个平衡计分卡角度中的哪个关键绩效指标(KPI)? ( )

- Which of the following would help to explain an adverse direct material price variance? ( ) 以下哪项将有助于解释直接材料的不利的价格差异? ( )

- A company with a HIGH operating leverage ( )经营杠杆率高的公司( )

- Which of the following are activities in the value chain? ( ) 以下哪一项是价值链中的活动? ( )

- Chem King uses a standard costing system in the manufacture of its single product. The 35,000 units of direct materials in inventory were purchased for $105,000, and two units of direct materials are required to produce one unit of final product. In November, the company produced 12,000 units of product. The standard allowed for materials was $60,000, and the unfavorable quantity variance was $2,500. Chem King's standard price for one unit of direct materials is ( )Chem King从事单一产品的生产,采用标准成本核算制度。库存的35 000单位直接材料以105 000美元购买,需要2个单位直接材料才能生产一个产成品。11月,公司生产了12,000台产品。允许材料的标准为60 000美元,不利数量差异为2 500美元。Chem Kin直接材料的单位标准价格为 ( )

- Which one of the following is true regarding a relevant range? ( )关于相关范围的论述,以下哪一项是正确的? ( )

- During the previous year, Morrison, Inc. produced 200,000 units of product and sold them all for $10 each. The explicit costs of production were $700,000,and the implicit costs of production were $200,000. The firm had ( )前一年,莫里森公司生产了20万台产品,每台售价10美元。显性的生产成本为70万美元,隐性生产成本为20万美元。公司有( )

- Lucy Sportswear manufactures a specialty line of T-shirts using a job-order costing system. During March, the following costs were incurred in completing job ICU2: direct materials, $13,700; direct labor, $4,800; administrative, $1,400; and selling, $5,600. Overhead was applied at the rate of $25 per machine hour, and job ICU2 required 800 machine hours. If job ICU2 resulted in 7,000 good shirts, the cost of goods sold per unit would be ( )Lucy 是一家运动服制造商,生产运动专业系列的 T 恤,采用分批法进行成本核算。3月份,完成订单ICU2的费用如下:直接材料,13 700美元; 直接人工4,800美元; 管理费用1 400美元; 销售费用5,600美元。间接费用按每台机器小时 25 美元的费率计算,订单 ICU2 需要 800 个机器小时。如果订单 ICU2 的产量为 7,000 件 T恤,则产品的单位销售成本为 ( )

- Marston Enterprises sells three chemicals:petrol, septine,and tridol. Petrol is the company's most profitable product; tridol is the least profitable. Which one of the following events will definitely decrease the firm's overall breakeven point for the upcoming accounting period? ( )Marston公司销售三种化学品:petrol, septine和 tridol。petrol是公司最赚钱的产品;tridol是最不赚钱的。以下哪一项事件肯定会降低公司在即将到来的会计期间的整体盈亏平衡点? ( )

- https://image.zhihuishu.com/zhs/doctrans/docx2html/202108/b6a5dd967e324fb986e04347467fa75e.png

- When job costing is in use,the purpose of an overhead application rate is to 使用分批法进行成本核算时,确定间接费用分配率的目的是( )

- The operations to produce a unit of product L require 9 active hours. Budgeted idle time of 10% of total hours paid for is to be incorporated into the standard times for all products. The wage rate is $4 per hour. The standard labour cost of one unit of product L is: ( )生产单位产品 L 实际要 9 个有效工时。公司预算的空闲时间为标准总工时的 10%,公司为这部分公司也支付工资,并将其计入产品的标准工时。工资标准是每小时4美元。单位产品 L 的标准人工成本是:( )

- Chem King uses a standard costing system in the manufacture of its single product. The 35,000 units of direct materials in inventory were purchased for $105,000, and two units of direct materials are required to produce one unit of final product. In November, the company produced 12,000 units of product. The standard allowed for materials was $60,000, and the unfavorable quantity variance was $2,500. Chem King's units of direct materials used to produce November output totaled ( )Chem King从事单一产品的生产,采用标准成本核算制度。库存的35 000单位直接材料以105 000美元购买,需要2个单位直接材料才能生产一个产成品。11月,公司生产了12,000台产品。允许材料的标准为60 000美元,不利数量差异为2 500美元。Chem Kin 11月用于生产的直接材料单位总计总量为 ( )

- The term that refers to costs incurred in the past that are not relevant to a future decision is ( )指过去发生的与未来决策不相关的成本的术语是 ( )

- 下列哪项能使边际贡献( Contribution margin )下降得最多?( )

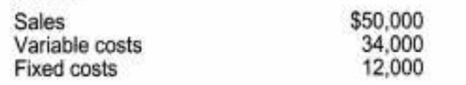

- The Alpha Division of a company, which is operating at capacity, produces and sells 1,000 units of a certain electronic component in a perfectly competitive market, Revenue and cost data are as follows:

在完全竞争市场中,某公司的 Alpha 部门的产能得到充分利用,生产和销售 1,000 台特定电子元件,收入和成本数据如下:

The minimum transfer price that should be charged to the Beta Division of the same company for each component is ( )

每个组件应向同一公司的 Beta 部门收取的最低转让价格为 ( ) - The difference between variable costs and fixed costs is ( )可变成本和固定成本之间的差别是 ( )

- Which of the following would not be used to estimate standard direct material prices? ( )估算直接材料的标准价格时,不考虑以下哪一项 ( ):

- The difference between the sales price and cost of goods sold is ( )销售价格和销售价格之间的差额是 ( )

- Several surveys point out that most managers use full product costs, including unit fixed costs and unit variable costs, in developing cost-based pricing. Which one of the following is least associated with cost-based pricing? ( )一些调查指出,大多数管理者在开发基于成本的定价时,都使用全部产品成本,包括单位固定成本和单位可变成本。以下哪一项与基于成本的定价关联最少? ( )

- Lamberton Manufacturing Company has just completed its master budget. The budget indicates that the company's operating cycle needs to be shortened. Thus, the company will likely attempt: 兰伯顿制造公司刚刚完成了总预算。 预算表明公司的经营周期需要缩短。 因此,该公司可能会尝试:( )

- A depreciation tax shield is ( )折旧税盾为 ( )

- The proper discount rate to use in calculating certainty equivalent net present value is the ( )计算确定性等值净现值时使用的适当贴现率是 ( )

- Which of the following is not a potential benefit of using budgets? 以下哪一项不是使用预算的潜在好处? ( )

- Wagner Corporation applies factory overhead based upon machine hours. At the beginning of the year, Wagner budgeted factory overhead at $250,000 and estimated that 100,000 machine hours would be used to make 50,000 units of product. During the year, the company produced 48,000 units using 97,000 machine hours. Actual overhead for the year was $252,000. Under a standard cost system, the amount of factory overhead applied during the year was ( )瓦格纳公司以机器工时为基础分配工厂间接费用。年初,瓦格纳将工厂间接费用预算为 250,000 美元,估计将用 100,000 个机器小时生产 50,000 台产品。公司实际生产了48,000台,使用97,000台机器小时。该年度的实际间接费用为252 000美元。在标准成本制度下,该年度分配的工厂间接费用金额为( )

- The margin of safety is a key concept of CVP analysis. The margin of safety is the ( )安全边际是 CVP 分析的关键概念。安全边际是指 ( ):

- The use of activity-based costing (ABC) normally results in ( )使用作业成本法 (ABC) 通常会导致 ( )

- A company makes a single product and incurs fixed costs of $30,000 per month. Variable cost per unit is $5 and each unit sells for $15. Monthly sales demand is 7,000 units. The breakeven point in terms of monthly sales units is: ( )一家公司生产单一产品,每月产生发生 30,000 美元的固定成本。单位可变成本为 5 美元,每单位售价为 15 美元。每月销售需求为 7,000 台。按月销售单位而言,盈亏平衡点是( ):

- The net present value(NPV)method of investment project analysis assumes that the project's cash flows are reinvested at the( )计算投资项目分析的净现值(NPV)时,假定项目的现金流量在按以下哪项进行再投资( )。

- Z plc makes a single product which it sells for $16 per unit. Fixed costs are $76,800 per month and the product has a contribution to sales ratio of 40%. In a period when actual sales were $224,000, Z plc's margin of safety, in dollars, was ( )Z plc 生产单一产品,每单位售价为 16 美元。固定成本为每月 76,800 美元,产品的边际贡献率为 40%。在实际销售额为 224,000 美元时,Z plc 的安全边际销售额是 ( )

- Which of the following would decrease unit contribution margin the most? ( )以下哪一选项将最大幅度降低单位边际贡献? ( )

- One of the major assumptions limiting the reliability of breakeven analysis is that ( )限制盈亏平衡分析可靠性的主要假设之一是: ( )

- Barney Co expected to produce 200 units of its product, the Bone, in 20X3. In fact 260 units were produced. The standard labour cost per unit was $70 (10 hours at a rate of $7 per hour). The actual labour cost was $18,600 and the labour force worked 2,200 hours although they were paid for 2,300 hours. What is the direct labour efficiency variance for Barney Co in 20X3? ( )巴尼公司预计在20X3年生产200台Bone产品,实际生产260台生产。单位标准人工费用为70美元(10小时,每小时7美元)。实际劳动力成本为18 600美元,实际的人工工时为2 200小时,尽管支付了2 300小时的费用。巴尼公司 20X3 中的直接人工效率差异是多少? ( )

- The price that one division of a company charges another division for goods or services provided is called the ( )公司内部一个部门向另一个部门提供的商品或服务而收取的费用称为( )

A:对 B:错

答案:错

A:错 B:对

答案:对

A:错 B:对

答案:错

A:对 B:错

答案:错

A:对 B:错

答案:对

A:对 B:错

答案:对

A:错 B:对

答案:错

A:错 B:对

答案:对

A:错 B:对

答案:对

A:对 B:错

A:错 B:对

A:错 B:对

A:对 B:错

A:错 B:对

A:对 B:错

A:错 B:对

A:错 B:对

A:对 B:错

A:对 B:错

A:对 B:错

A:If finished goods inventory increases, absorption costing results in higher income.

如果产成品库存增加,则吸收成本法会导致更高的收益。

B:Variable manufacturing costs are lower under variable costing.

在可变成本法下,可变制造成本较低。

C:Overhead costs are treated in the same manner under both costing methods.

两种成本法都以相同的方式处理间接费用。

D:Gross profit is the same under both costing methods.

两种成本法下的毛利都相同。

A:Indirect materials 间接材料

B:Indirect labor 间接人工

C:Period costs, such as depreciation on office computers 期间成本,例如办公计算机的折旧

D:Other indirect manufacturing costs, such as plant utilities其他间接制造成本,例如工厂水电费

A:Customer Service 客户服务

B:Research and develop研发

C:Marketing 市场营销

D:Production 生产

A:Are expensed when products become part of finished goods inventory.

当产品成为产成品库存的一部分时计入费用。

B:Are regarded as assets before the products are sold.产品出售前被视为资产。

C:Include the conversion costs of manufacturing a product. 包括制造产品的转换成本。

D:Include the prime costs of manufacturing a product. 包括制造产品的主要成本。

A:Usefulness in budgeting预算编制的有用性

B:Cost benchmarks成本基准

C:Standard costing systems simplify bookkeeping标准成本核算系统简化簿记

D:Motivation动机

A:Other indirect manufacturing costs, such as plant utilities其他间接制造成本,例如工厂水电费

B:Indirect materials 间接材料

C:Depreciation on equipment 设备折旧

D:Indirect labor 间接劳动

A:Financial 财务

B:Learning and growth学习与成长

C:Internal business 内部业务

D:Customer 客户

A:All of the choices. 所有选项

B:The material purchased was of a higher quality than standard.购买的材料质量高于标准质量。

C:The standard price per unit of direct material was unrealistically high

直接材料的单位标准价格过高

D:A reduction in the level of purchases meant that expected bulk discounts were forgone

购买水平下降意味着放弃预期的批量折扣。

A:Has relatively more variable costs than fixed costs 与固定成本相比,其可变成本相对更多

B:Has an equal proportion of fixed and variable costs 固定成本和可变成本的比例相等

C:Has relatively more fixed costs than variable costs 固定成本相对高于可变成本

D:Has relatively more risk than a company with low operating leverage比经营杠杆率低的公司风险高

A:Distribution派送

B:Design 设计

C:Marketing 营销

D:Research and develop研发

A:$2.50

B:$5.00

C:$2.00

D:$3.00

A:Total fixed costs will not change. 相关范围内,总成本保持不变。

B:The relevant range cannot be changed after being established.一旦确立,相关范围就不能改变。

C:Actual fixed costs usually fall outside the relevant range.实际固定成本通常超出相关范围。

D:Total variable costs will not change. 相关范围内,变动成本总额保持不变。

A:An accounting profit of $1.1 million and an economic profit of $0.

会计利润 110 万美元,经济利润 0 美元。

B:An accounting profit of $1.3 million and an economic profit of $1.1 million.

会计利润130万美元,经济利润110万美元。

C:An accounting profit of $1.3million and an economic profit of $1.5 million.

会计利润130万美元,经济利润150万美元。

D:An accounting profit of $1.3 million and an economic profit of $1.3 million.

会计利润130万美元,经济利润130万美元。

A:$6.50

B:$6.30

C:$5.70

D:$5.50

A:The installation of new computer-controlled machinery and subsequent layoff of assembly-line workers.安装新的计算机控制机械并解雇装配线工人。

B:A decrease in tidol's selling price. 降低tridol的销售价格。

C:An increase in anticipated sales of petrol relative to sales of septine and tridol. 增加petrol的销售。

D:An increase in the overall market for septine. 拓展septine的总体市场

A:$160,000

B:$380,000

C:$220,000

D:$367,650

A:Assign a portion of indirect manufacturing costs to each product manufactured.

将一部分间接制造成本分配给制造的每个产品。

B:Charge the Work in Process Inventory account with the appropriate amount of direct manufacturing costs.

用适当数量的直接制造成本记入在产品存货帐户。

C:Determine the type and amount of costs to be debited to the Manufacturing Overhead account.

确定要借记到制造费用帐户的成本类型和金额。

D:Allocate manufacturing overhead to expense in proportion to the number of units manufactured during the period.

根据期间制造的产品的数量,将制造费用按比例进行分配。

A:$39.60

B:$40.00

C:$36.00

D:$10.00

A:23,000 units.

B:12,500 units.

C:25,000 units.

D:12,000 units.

A:Sunk cost. 沉没成本;

B:Discretionary cost. 酌量性成本

C:Full absorption cost. 完全吸收成本

D:Under-allocated indirect cost. 分配不足的间接成本

A:Variable expenses decreased by 15%

变动费用下降 15%

B:Selling price decreased by 15%

售价下降 15%

C:Fixed costs decreased by 15%

固定费用下降 15%

D:Variable expenses increased by 15%

变动费用增加 15%

A:$50

B:$12

C:$34

D:$46

A:Total variable costs are variable over the short run and fixed in the long term, while fixed costs never change.

总可变成本是短期可变的,长期是固定的,而固定成本永远不会改变。

B:Variable costs per unit are fixed over the short run, and fixed costs per unit are variable.

单位可变成本在短期内是固定的,单位固定成本是可变的。

C:Variable costs per unit fluctuate,and fixed Costs per unit remain constant.

单位可变成本波动,单位固定成本保持不变。

D:Variable costs per unit change in varying increments, while fixed costs per unit change in equal increments.

单位可变成本以不同的增量变化,而单位固定成本以相等的增量变化。

A:Purchase contracts already agreed 已商定的采购合同

B:Performance standards in operation 运营的绩效标准

C:The forecast movement of prices in the market 市场价格的预测走势

D:The availability of bulk purchase discounts 批量采购的折扣

A:The contribution margin. 边际贡献

B:Gross profit. 毛利

C:Net profit. 净利

D:The breakeven point. 盈亏平衡点

A:Price stability. 物价稳定新

B:Price justification. 价格合理性

C:Fixed-cost recovery. 固定成本回收

D:Target pricing. 目标成本法

A:None selections is correct.

没有正确的选项。

B:Tightening credit policies.

收紧信贷政策。

C:Stocking larger inventories.

储存较大的库存。

D:Reducing cash discounts for prompt payment.

减少及时付款的现金折扣。

A:The expense caused by depreciation. 折旧导致的费用。

B:A reduction in income taxes. 所得税的减少

C:An after-tax cash outflow. 税后现金流出

D:The cash provided by recording depreciation. 通过折旧的会计处理提供的现金。

A:Cost of capital. 资金成本

B:Cost of equity capital. 股本成本

C:Risk-free rate. 无风险利率

D:Risk-adjusted discount rate. 风险调整贴现率。

A:Enhanced coordination of firm activities.

加强对公司活动的协调。

B:More motivated managers.

更能激励管理者。

C:More accurate external financial statements.

更准确的外部财务报表。

D:Improved interdepartmental communication.

改进部门间沟通。

A:$250,000

B:$242,500

C:$240,000

D:$252,000

A:Contribution margin rate.边际贡献率

B:Difference between the breakeven point in sales and cash flow breakeven. 盈亏平衡点销售额与盈亏平衡点现金流量之间的差值。

C:Difference between budgeted contribution margin and breakeven contribution margin. 预算的编辑贡献和盈亏平衡边际贡献的差额。

D:Difference between budgeted sales and breakeven sales.预算销售额和盈亏平衡销售之间的差额。

A:Equalizing setup costs for all product lines.均衡所有产品线的设备调试成本。

B:Decreased setup costs being charged to low-volume products. 降低小批量产品的设备调试成本。

C:Substantially lower unit costs for low-volume products than is reported by traditional product costing.

与传统产品成本相比,小批量产品的单位成本要低得多。

D:Substantially greater unit costs for low-volume products than is reported by traditional product costing.

与传统产品成本相比,小批量产品的单位成本要大得多。

A:6,000 units

B:4,000 units

C:3,000 units

D:2,000 units

A:Computed internal rate of return. 计算的内部回报率。

B:Firm's accounting rate of return. 公司的会计回报率。

C:Discount rate used in the NPV calculation. 净现值计算中使用的贴现率。

D:Risk-free interest rate. 无风险利率

A:32,000

B:22,000

C:2,500

D:16,000

A:A 15% decrease in selling price. 售价下降15%

B:A15% decrease in fixed expenses. 固定费用减少15%。

C:A 15% decrease in variable expenses. 可变费用减少 15%。

D:A 15% increase in variable expenses. 可变费用增加 15%。

A:Efficiency and productivity will continually increase. 效率和生产能力将不断提高。

B:Total variable costs will remain unchanged over the relevant range.在相关范围内,总可变成本将保持不变。

C:The cost of production factors varies with changes in technology.生产要素的成本随技术的变化而变化。

D:Total fixed costs will remain unchanged over the relevant range总固定成本在相关范围内保持不变

A:$2,800 (F) B:$400 (F) C:$2,800 (A) D:$2,100 (F)

A:Market price. 市场价

B:Outlay price. 支出价格

C:Transfer price. 转让价格

D:Distress price. 处理价

温馨提示支付 ¥5.00 元后可查看付费内容,请先翻页预览!