上海电机学院

- Which one of the following electronic systems is dedicated for real-time interbank payment made within the UK? ( )

- The collecting bank will make a protest only when _____________ . ( )

- Which of the following statement associated with international factoring and forfeiting is incorrect? ( )

- In documentary collection, from the perspective of the exporter, which term of releasing document is most favorable? ( )

- Which one of the following statements is a demonstrative order in a typical draft? ( )

- Which one of the following types of documentary credit allows the seller (beneficiary) to receive all or part of the purchase price only if seller store the goods in the name of advising or confirming bank? ( )

- In remittance, a bank that is entrusted in the payment order to pay a certain amount of money to the payee or beneficiary is termed as ________. ( )

- Which one of the following guarantees is employed to assure that the tenderer will perform the contract as signed? ( )

- Which one of the following items not required by a negotiable instrument? ( )

- Which one of the following types of documentary credit allows beneficiary to use credit as security to open a separate and new credit in favor of the real supplier? ( )

- Which one of the following payment techniques does not require for the payment guarantee from involved banks? ( )

- Which one of the following types of documentary credit permits the beneficiary to negotiate the drafts and documents with a nominated bank under a complying presentation? ( )

- The following statements are utilized in describing the difference between a joint note and a joint and several note. Which one of these statements is incorrect? ( )

- Which one of the following services is not included in the service package provided by a factor? ( )

- Which of the following bill of lading is not negotiable? ( )

- Which one of the following statements does not belonging to the condition of a holder in due course? ( )

- The following statements are used to describe the difference between a draft (bill of exchange) and a promissory note. Which one of the following statements is correct? ( )

- ___________ certifies that the goods were produced in a particular country. ( )

- The international settlement methods experienced four major evolution process, which one of the following statements is correct? ( )

- In international trade payments, which one of the following statements is not the concern of exporter? ( )

- Which one of the following types of document is not a financial document? ( )

- Which one of the following statements does not belong to the motivation of inserting the issuing date and place into the main body of a draft (bill of exchange)? ( )

- Which one of the following documents is employed as an accounting document by which the seller claims payment from buyer for the value of the goods being supplied? ( )

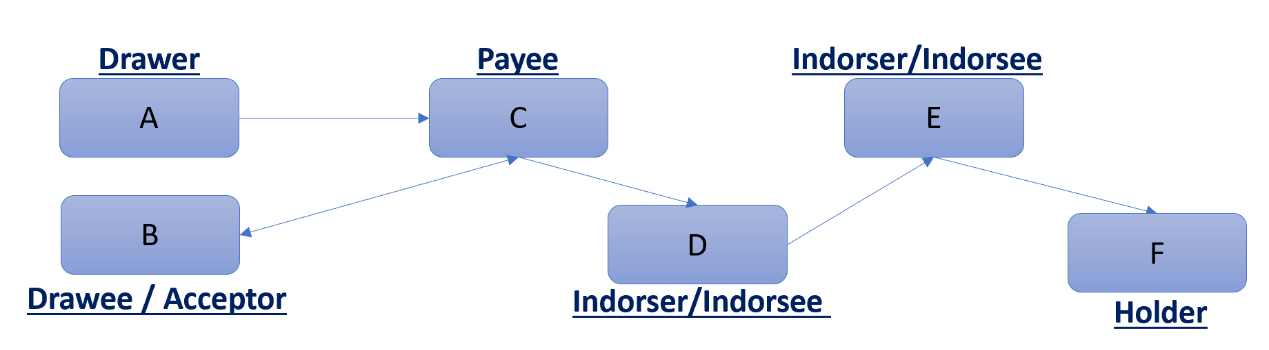

- According to the process flow chart as stated below, assuming party X make payment in honor of C, which party or parties are still liable for this draft? ( )

- The documentary credit has the following clause: “Available with United Overseas Bank by payment at 45 days after sight against the documents detailed herein, no acceptance is required. “What is the type of this credit? ( )

- In the transaction of a cheque, the drawer and the payer are the same person (or entity). ( )

- The holder for value is also named as a bona-fide holder. ( )

- A bill of exchange is a conditional order in writing. ( )

- According to Uniform Law for Bills of Exchange and Promissory Notes (Geneva, 1930), partial acceptance, by which the drawee only agrees to pay part of the amount for which the bill is drawn, is allowed. ( )

- Payee has the right to ask the drawer to pay and has the right of recourse if the instrument is dishonored by non-payment or non-acceptance. ( )

- A documentary collection is an agreement whereby the seller draws only a draft on buyer for the value of the goods and presents the draft to his bank. ( )

- There is no acceptor in a promissory note. ( )

- If the instructions are D/P means the importer's bank will release all documents to the importer against instant payment made by the importer. ( )

- CNAPS was improved in 2010 and now PBOC (People's Bank of China) is developing the second-generation payment system. ( )

- The import T/T finance is a short-term financing provided by bank to the importer. ( )

- Under the documentary collection, drafts which are payable at a future date are called demand draft. ( )

- Banks have no liability for the consequences arising out of delay and/or loss in transit of any messages arising in transmission of any telecommunication. ( )

- Demand draft (D/D) is safe and fast in contrast to telegraphic transfer as the working principle is alike to bill of exchange. ( )

- Western Union (WU) is one of the largest international remitting companies and the earliest one that has entered into China. ( )

- Choosing which type of remittance is used solely depends on the remitting bank. ( )

- A negotiable instrument exists independent of the commercial relationship from which it is originated. ( )

- Under the documentary collection, the remitting bank has no obligation on examining the documents. ( )

- The TARGET system was specifically designed for the euro and commenced operations on 1999. ( )

- In ancient times, indirect payment is based on barter or cash basis. ( )

- Negotiable instruments can be employed as payment instruments only. ( )

- Export T/T financing is also called export invoice financing whereas bank make payment to the exporter before the importer pays. ( )

- "Please pay Shanghai DianJi University a sum of two hundred and fifty Chinese Yuan only." is a payable to bearer order. ( )

- In the case of bank certified cheque, the certified bank will be the principal obligor and the remaining parties will be the secondary obligors. ( )

- Under collection, once the goods have arrived at the destination while the bill is not mature due to the D/P after sight is utilized. The collecting bank is willing to release the documents under T/R without any cash deposits provided by the importer. ( )

- By referring to the UK Bills of Exchange Act 1882, it is not necessary to protest any inland bill in order to preserve the right of recourse against all obligors. ( )

A:CHAPS Sterling B:Fedwire Funds Service C:CHIPS D:Faster Payments

答案:A: CHAPS Sterling

A:protective measures in respect of the goods are taken B:a case of need is nominated C:specific instructions concerning protest are given D:the documents are rejected

答案:C: specific instructions concerning protest are given

A:The underlying risk associated with international forfeiting involves commercial, political, and foreign exchange risk. B:International factoring provides short-term financing of less than 6 months. C:Within the international factoring, the risk undertook by the factor is lying on commercial and foreign exchange risk. D:The forfeiter does not use credit line as a way of mitigating the risk in the transaction of international forfeiting.

答案:Within the international factoring, the risk undertook by the factor is lying on commercial and foreign exchange risk.

A:D/A B:D/D C:D/P at sight D:D/P after sight

答案:D/P at sight

A:"Please pay Shanghai DianJi University only a sum of one thousand US dollar." B:"Please pay Shanghai DianJi University a sum of one thousand US dollar only." C:"Please pay Shanghai DianJi University or bearer a sum of one thousand US dollar only." D:"Please pay Shanghai DianJi University not transferable a sum of one thousand US dollar only."

答案:"Please pay Shanghai DianJi University a sum of one thousand US dollar only."

A:Advance payment credit B:Red clause credit C:Green clause credit D:Negotiation credit

答案:C: Green clause credit

A:remitting bank B:paying bank C:operating bank D:correspondent bank

答案:paying bank

A:Counter guarantee B:Repayment guarantee C:Advance payment guarantee D:Performance guarantee

答案:Advance payment guarantee

A:The value of instrument. B:The specified condition to be fulfilled by the payee. C:The identity (or the name) of the instrument. D:The date of issue and place.

答案:B: The specified condition to be fulfilled by the payee.

A:Revolving credit B:Transferrable credit C:Back-to-back credit D:Negotiation credit

A:Guarantee from bank B:Documentary collection C:Letter of credit D:Standby letter of credit

A:Negotiation credit B:Transferrable credit C:Straight credit D:Revolving credit

A:For joint and several note, each maker is individually liable for the full amount of the note. B:For joint note, the holder can sue each one of the makers in turn. C:For joint note, the holder has only one right of suing action. D:For joint and several note, the death of a maker will not extinguish the liability.

A:Cash line B:Credit investigation C:Payment on account D:Collection of proceeds

A:Straight bill of lading B:Shipped bill of lading C:Direct bill of lading D:Order bill of lading

A:The holder confirmed the instrument has no alteration. B:The holder noticed the defect in the title of the person who negotiated it. C:The holder took the draft for service or value provided. D:The holder must in good faith.

A:Promissory note is a three-party instrument, draft is a two-party instrument. B:For a note, it is an order to pay, while for a draft, it is a promise to pay. C:Promissory note is made in a set which consists of two isolated copies, while for a draft, it is made in one copy only. D:For a note, the maker is the party liable primarily for payment, while for a draft, it is depending on the status of acceptance.

A:A certificate of origin B:A weight list C:An inspection certificate D:A place certificate

A:From non-cash settlement to cash settlement B:From complex price terms to simple price terms C:From simple price terms to complex price terms D:From indirect payment to direct payment

A:The inability of the importer to obtain sufficient financing. B:The deterioration in the importer's operations and sales result in insufficient cash flow. C:The transfer risk associated with the inability of converting received soft currency into a hard currency. D:The goods meet the specified level of quality.

A:Promissory Note B:Bill of exchange C:Cheque D:Certificate of origin

A:The issuing place is used to determine the validity of international draft for political reasons. B:The issuing date is adopted to determine the expiry date. C:The issuing place is used to determine the validity of international draft for economic reasons. D:The issuing date is employed as a record for future reference.

A:Inspection certificate B:Commercial invoice C:Bill of lading D:Certificate of origin

A:Party A B:Party C:Party B D:B and C E:Party A and B

A:Deferred payment credit B:Restricted negotiation credit C:Acceptance credit D:Free negotiation credit

A:对 B:错

A:对 B:错

A:对 B:错

A:错 B:对

A:对 B:错

A:对 B:错

A:错 B:对

A:错 B:对

A:错 B:对

A:对 B:错

A:错 B:对

A:对 B:错

A:对 B:错

A:对 B:错

A:错 B:对

A:错 B:对

A:对 B:错

A:对 B:错

A:对 B:错

A:错 B:对

A:对 B:错

A:对 B:错

A:对 B:错

A:对 B:错

A:对 B:错

温馨提示支付 ¥5.00 元后可查看付费内容,请先翻页预览!