- Selling equipment for cash is reported on the statement of cash flows under( )

- On October 1,2021,Freedom Communications purchased a new piece of equipment that cost $35,000.The estimated useful life is five years and estimated residual value is $8,000.Assume that Freedom uses the straight-line method of depreciation and sells the equipment for $22,400 on October1,2025.The result of the equipment is a gain (loss) of.( )

- A company purchased an oil well for $210,000.It estimates that the well contains 30,000barrels,has an ei-ght-year life, and no salvage value. If the company extracts and sells 2,000 barrels of oil in the first year, how much in cost of sales should be recorded?( )

- Which of the following assets are not included in “cash equivalents” in a typical balance sheet?( )

- On January 1,2021,Freedom Communications purchased a new piece of equipment that cost$35,000.The estimated useful life is five years and estimated residual value is $8,000.If Freedom uses the straight-line method for depreciation, what is the asset's book value at the end of 2022?( )

- Trigg Corporation purchased treasury stock in 2021 at a price of $22 per share and resold the treasury stock in 2022 at a price of $42 per share. What amount should Trigg report on its income statement for 2022?( )

- Bell Company had cost of goods sold of $160,000. The beginning and ending inventories were $8,000 and $23,000,respectively. Purchases for the period must have been( )

- In 2021,MLL Corporation borrowed $90,000, paid dividends of $26,000, issued12,000 shares of stock for $20 per share, purchased land for $25,000, and received dividends $10,000. Net income was $120,000 and depreciation for the year totaled$11,000. Accounts receivable increased by$10,000. How much should be reported as netcash provided by operating activities by the indirect method? ( )

- Strips Ltd. received a four-month, 7%, $15,000 note receivable on March 1.The adjusting entry on March 31 will include( )

- The nature of an asset is best described as( )

- Dove, Inc., manufactures and sells computer monitors with a three-year warranty. Warranty costs are expected to average 7% of sales during the warranty period. The follow table shows the sales and actual warranty payments during the first two years of operations: Year Sales Warranty Payments 2020 $650,000 $5,200 2021 $850,000 $42,500Based on these facts, what amount of warranty liability should Dove., report on its balance sheet at December 31, 2021?( )

- On the statement of cash flows, activities that create long-term liabilities are usually( )

- Palamino Company had an $18,000 beginning inventory and a $21,000 ending inventory. Net sales were 200,000; purchases, $95,000; purchase returns and allowances, $6,000; and freight in,$8,000.What is Palamino's rate of inventory turnover?( )

- T-BAR-T Tennis Academy held investments in trading securities with a fair value of$90,000 at Dece-mber 31, 2021. These investments cost T-BAR-T $76,000 on January1,2021. What is the appropriate amoun-t for T-BAR-T to report for these investments on the December 31, 2021, balance sheet?( )

- Which financial statement covers a period of time?( )

- The basic summary device of accounting is the( )

- In a double-entry accounting system,( )

- A check was written for $462 to purchase supplies. The check was recorded in the journal as $426.The entry to correct this error would( )

- The stockholders’ equity of Kozlozsky Company at the beginning and end of 2021 totaled $12600 and $138,000, respectively. Assets at the beginning of 2021 were $150,000. If the liabilities of Kozlozsky Com-pany increased by $70,000 in 2021, how much were total assets at the end of 2021? Use the accounting eq-uation.( )

- The carrying value of Bonds Payable equals( )

- FedEx earns service revenue of $750,000. How does this transaction affect FedEx’s current and debt ratios?( )

- Shore, Inc., owns 80% of Rockwall Corporation, and Rockwall owns 80% of SmithCompany. During 2021, these companies' net incomes are as follows before any consolidations:Shore,$160,000Rockwalls,$70,000Smith,$40,000How much net income should Shore report for 2021?( )

- Accounts Payable had a normal beginning balance of $1,000. During the period, there were debit postings of $500 and credit postings of $600. What was the ending balance?( )

- The numerator for computing the rate of return on total assets is( )

- The accounting equation can be expressed as( )

- When inventory is delivered to a customer, the cost of inventory become an expense?( )

- Assets are usually reported at their historical cost.( )

- The Discount on Bonds Payable account is a contra account to Bonds Payable.( )

- An adjusting entry that debits an expense and credits a liability is accrued expense.( )

- You are taking a vacation to Germany and you buy Euros for $1.65. On your return,you cash in your unused Euros for $1.40. During your vacation, the Euro rose against the dollar.( )

- Companies with strong liquidity usually factor receivables.( )

- The payment of the face amount of a bond on its maturity date is regarded as an operating activity.( )

- The organization that formulates generally accepted accounting principles in the United Stated is the Financial Accounting Standards Board.( )

- The expense recognition principle directs accountants to identify and measure all expenses incurred and deduct them from revenues earned during the same period.( )

- Taxes paid in conjunction with the purchase of office equipment should be accounted for as a capital expenditure.( )

- Assets and Revenues are increased by credits.( )

- Majestic, Inc., holds an investment in Cromwell bonds that pay interest each October31. Majestic's balance sheet at December 31 should report interest payable.( )

- Accelerated depreciation generates a greater amount of depreciation over the life of the asset than does straight-line depreciation.( )

- Dividends received on an equity-method investment increase the investment account.( )

- The error of posting $50 as $500 can be detected by dividing the out-of-balance amount by 9.( )

- The financial statement that reports revenues and expenses is called the income statement.( )

- Another name for the balance sheet is the statement of profit and loss.( )

- Stockholders' equity account is increased in debit.( )

- Goodwill is not subject to a decreasing book value through depreciation, depletion, or amortization.( )

- Purchasing computer equipment for cash will have no effect on total assets, total liabilities, or stockholders equity.( )

- An investment of cash by stockholders in the business will decrease total assets.( )

- ROA is an important measure of profitability.( )

- Allowance for bad debts is an estimated liability.( )

- A copyright,a trademark,a patent,all of the above are intangible assets.( )

- Inventory turnover is an important measure of profitability.( )

- On January 1,2021,Freedom Communications purchased a new piece of equipment that cost$35,000.The estimated useful life is five years and estimated residual value is $8,000.IF Freedom uses the double-declining-balance method, what is depreciation for 2022?( )

- The fllowing normal balances appear on the adjusted trial balance of Adams Company:Equipment.................................................................$90,000Accumulated depreciation, equipment..........$12,000Depreciation expense, equipment ....................$3,000The book value of the equipment is( )

- An attorney performs services of $1,100 for a client and receives $400 cash with the remainder on acco-unt. The journal entry for this transaction would( )

- FourStar, anew company, cmpleted these transactions:(1)Stockholders invested $54,000 cash and inventory with a fair value of $30,000; (2)Sales on account, 22,000. What will FourStar’s total assets equal?( )

- The journal entry to record the receipt of land and a building and issuance of common stock( )

- An adjusting entry recorded June salary expense that will be paid in July. Which statement best describ-es the effect of this adjusting entry on the company's accounting equation?( )

- Stock dividends( )

- Suppose George's Delivery pays $66 million to buy Lone Star Overnight.The fair value of Lone Star's assets is $72 million, and the fair value of its liabilities is $23 million. How much goodwill did George's Delivery purchase in its acquisition of Lone Star Overnight?( )

- Interest earned on a note receivable at December 31 equals $225. What adjusting entryis required to accrue this interest?( )

- Consolidation of a foreign subsidiary usually results in a( )

- The ending inventory of Carroll Co. is $46,000. If beginning inventory was $70,000 and goods available(cost of goods available for sale) totaled $115,000 ,the cost of goods sold is( )

- Suppose you buy land for $3,000,000 and spend $1,000,000 to develop the property. You then divide the land into lots as follows:15 Hilltop lots...…………Sale Price per Lot $480,00015 Valley lots…………… Sale Price per Lot$270,000How much did each hilltop lot cost you?( )

- During February, assets increased by $84,000 and liabilities increased by $26,000. Stockholders' equity must have( )

- Palamino Company had an $18,000 beginning inventory and a $21,000 ending inventory. Net sales were 200,000; purchases, $95,000; purchase returns and allowances, $6,000; and freight in,$8,000.What is Palamino's gross profit percentage (rounded to the nearest percentage)? ( )

- A contingent liability should be recorded in the accounts( )

- Which of the following accounts is not closed?( )

- What is the effect of a stock dividend and a stock split on total assets?( )

- Borrowing money from a bank will increase an asset and increase stockholders’ equity.( )

- A maior purpose of preparing closing entries is to adjust the asset accounts to their current balances.( )

- An unsecured bond is a debenture bond.( )

- On the statement of cash flows, activities affecting long-term assets are financing activities.( )

- Cash dividend is not a legal liability.( )

- Depreciation should not be recorded in years in which the market value of the asset has increased.( )

- The purchase of treasury stock decreases total assets and increases total stockholders' equity.( )

- Mac's investment in less than 2% of Mobil's stock, Mac expect to hold for three years and then sell, this type of investment is available-for-sale.( )

- Gross profit is the excess of goods sold.( )

- The direct write-off method of accounting for uncollectable understates assets.( )

- Ledger, trial balance, journal, financial statements is the correct sequence for recording transactions and preparing financial statements.( )

- Prepaid expenses and cash is included in the calculation of the quick (acid-test) ratio.( )

- On the statement of cash flows, activities that create long term liabilities are usually investing activities.( )

- When a bond is sold at a discount, the cash received is less than the present value of the future cash flows from the bond, based on the market rate of interest on the date of issue.( )

- The word market as used in “the lower of cost or market"generally means: current replacement cost.( )

- Internal control procedures include assignment of responsibilities,internal and external audits,adequate records.( )

- In internal control, requiring employees without cash to conduct accounting is an example of responsibility separation.( )

- One of the internal control’s objective is monitoring.( )

- During a period of rising prices, the inventory method that will yield the highest net income and asset value is FIFO.( )

- The inventory method that best matches current expense with current revenue is FIFO.( )

- Professional accountants are held to a high standard of ethical conduct.( )

- Which of the following reconciling items does not require a journal entry?( )

- On October 1,2021,Freedom Communications purchased a new piece of equipment that cost$35,000.The estimated useful life is five years and estimated residual value is $8,000.What is the depreciation expense for 2021 if Freedom uses the straight-line method?( )

- The sale of inventory for cash is reported on the statement of cash flows under( )

- Which of the following is not needed to compute the present value of an investment?( )

- Which of the following costs are reported on a company's income statement and balance sheet?( )

- WilliamsInstruments had retained earnings of $350,000 at December 31,2020. Net income for 2021 totaled $183,750,anddividends declared for 2021 were $78,750.How much retained earnings should Williams report at December 31, 2021?( )

- During the year, Aynsley, Inc., has $280,000 in revenues, $145,000 in expenses, and $6,000in dividend declarations and payments. Aynsley, Inc., had( )

- A company bought a new machine for $23,000 on January 2021. The machine is expected to last four years and to have a residual value of $3,000.If the company uses the double-declining-balance method, accumulated depreciation at the end of year 2022 will be( )

- The denominator for computing the rate of return on equity is( )

- What is the present value of bonds with a face value of $5,000; a stated interest rate of 6%;a market rate of 8%;and a maturity date four years in the future? Interest is paid semiannually.( )

- Which of the following is the most accurate statement regarding ethics as applied to decision making in accounting?( )

- When do dividends increase stockholders' equity?( )

- Palamino Company had an $18,000 beginning inventory and a $21,000 ending inventory. Net sales were 200,000; purchases, $95,000; purchase returns and allowances, $6,000; and freight in,$8,000.Cost of goods sold for the period is( )

- Berkshire Farms, Ltd., made sales of $680,000 and had cost of goods sold of $440,000.Inventory dcreased by $25,000, and accounts payable decreased by $12,000. Operatingexpenses were $195,000. How much was Berkshire Farms’net income for the year?( )

- The discount on a bond payable becomes( )

- T-BAR-T Tennis Academy held investments in trading securities with a fairvalue of$90,000 at December 31, 2021. These investments cost T-BAR-T $76,000 on January1,2021. What should appear on the T-BAR-T income statement for the year ended December 31, 2021, for the trading securities ?( )

- Salary Expense is an asset account.( )

- Retained earnings and inventory are reported on the balance sheet.( )

- The trial balance is a list of all accounts with their balances.( )

- The journal entry to record a payment on account will debit Cash and credit Account Payable.( )

- Accumulated Depreciation would not be included in the closing entries.( )

- Sales Revenue is current assets.( )

- Depreciation is a process of allocating the cost of an asset to expense over its useful life.( )

- The simultaneous increase of assets and liabilities will certainly affect the accounting equation.( )

- In a bank reconciliation, interest revenue earned on your bank balance is deducted from the bank balance.( )

- When cash received over the counter, the cash drawer should open only when the sales clerk enters an amount on the keys.( )

- Preferred stock have the preference as to voting.( )

- Operating activities,investing activities,financing activities are reported on the statement of cash flows.( )

- Consolidation accounting combines the accounts of the parent company and those of the subsidiary companies.( )

- The valuation of assets on the balance sheet isgenerally based on( )

- A bond that matures in installments is called a( )

- Purchasing a laptop computer on account will( )

- Adjusting entries( )

- Which item(s) is (are) reported on the balance sheet?( )

- Morton Corporation began the year with cash of $140,000 and land that cost $24,800.During the year Morton earned service revenue of $285,000 and had the following expenses:salaries, $209,000; rent, $86,000; and utilities, $27,000. At year-end, Morton's cash balance was down to $79,000. How much net income (or net loss) did Morton experience for the year?( )

- During the year, Aynsley, Inc., has $280,000 in revenues, $145,000 in expenses, and $6,000in dividend declarations and payments. Stockholders' equity changed by( )

- On November 1, Brownstone Apartments received $3,600 from a tenant for four months' rent. The receipt was credited to Unearned Rent Revenue. What adjusting entry is needed on December 31?( )

- Which statement is true?( )

- Dawson Company is authorized to issue 70,000 shares of $2 par common stock. On November 30,2021, Dawson issued 10,000 shares at $22 per share. Dawson's journal entry to record these facts should include a( )

- Horizontal analysis is performed on information getting from:( )

- A business's receipt of a $105,000building, with a $90,000 mortgage payable, and issuance of $15,000 of common stock will( )

- Net income appears on which financial statement(s)? ( )

- In a bank reconciliation, an outstanding check is deducted from the bank balance.( )

- The paid-in capital portion of stockholders' equity include:Paid-in Capital in Excess of Par Value,Common Stock,and Retained Earnings.( )

- In a double-entry accounting system:liabilities, owners' equity, and revenue accounts all have normal debit balances.( )

- If a bookkeeper mistakenly recorded a $72 deposit as $27, the error would be shown on the hank reconciliation as a $45 addition to the book balance.( )

- If a bank reconciliation included deposit in transit of $790, the entry to record this reconciling item would include a credit to Prepaid insurance for $790.( )

- Depreciation is based on the expense recognition principle because it apportions the cost of the asset against the revenue generated over the asset’s useful life.( )

- In the financial statements, sales discounts should appear as a deduction from sales.( )

- The basic summary device of accounting is the account.( )

- On date of payment, a cash dividend become a legal liability.( )

- Trend percentages are:( )

- The formula for the cash conversion cycle is:( )

- The formula for the current ratio is:( )

- Refer to Browne Corporation. What is the inventory turnover for 20X2?( )

- Which ratio is used to analyze stock as an investment? ( )

- Refer to Browne Corporation. What is the ROA for 20X2?( )

- Refer to Browne Corporation. The percentage change in Notes Payable is:( )

- Refer to Browne Corporation. The debt ratio in 20X1 is: ( )

- Refer to Browne Corporation. The current ratio in 20X1 is: ( )

- Which of the following does not have an effect on cash?( )

- The MNO corporation purchased a large machine 7 years ago at a total cost of $500,000. The accumulated depreciation on this machine is $390,000. The corporation sold the machine at a $20,000 gain. What amount would be reported as cash proceeds from this sale?( )

- The Webster Company had $800,000 of sales revenue. During the same accounting period the beginning and ending accounts receivable balance was $37,000 and $39,000, respectively. What amount of cash was collected from the customers during this period?( )

- The statement of cash flows is designed to fulfill all the following purposes EXCEPT to:( )

- The statement of cash flows provides information about:( )

- In which section of the statement of cash flows would “payment of dividends” be reported?( )

- Purchases of long-term assets are reported in which section of the statement of cash flows?( )

- Which of the following items are not included in determining the cash payments (outflows) from financing activities? ( )

- Which of the following is included in the calculation of cash receipts from investing activities?( )

- Baier Corporation reports cost of goods sold of $88,000 and a decrease in inventory during the year of $5,000. All accounts payable relate to inventory purchases; accounts payable decreased by $2,400 during the year. How much cash did Baier pay for inventory during the year? ( )

- Which of the following is part of stockholders’ equity?( )

- An entity is authorized to sell 60,000 shares of $11 par, 6% cumulative preferred stock and 110,000 shares of $7 par common stock. There are 30,000 shares of preferred stock outstanding and 90,000 shares of common stock outstanding. A $50,000 cash dividend has been declared by the board of directors. No dividends in arrears exist. What is the total amount to be given to the preferred shareholder? ( )

- Refer to Question 3. How much is the common stock dividend per share (rounded)?( )

- In calculating total stockholders’ equity, which account is included?( )

- Braxton Company uses the DuPont model to analyze profitability. Which statement(s) is (are) correct?( )

- Which of the following is a right of a stockholder?( )

- Troy Corporation issued 50,000 shares of $1 par common stock at a price of $5 per share. On June 1, Troy purchased 2,000 shares of its own stock at a cost of $7 per share. On December 1, Troy resold all the shares for $8 each. The entry on December 1 would include which of these?( )

- The entry to sell 100 shares of $12 par common stock at $17 per share would include a: ( )

- Which of the following statements are NOT true regarding stock transactions?( )

- Authorized stock is which of the following?( )

- The Singletary Company issued a $500,000, 5-year, 6% bond at par. It is a semiannual bond with interest paid on June 30th and December 31st.The entry to record the sale of the bond would include a:( )

- The Singletary Company issued a $500,000, 5-year, 6% bond at par. It is a semiannual bond with interest paid on June 30th and December 31st. The entry to record the semiannual interest payment is:( )

- Which of the following is not true about a contingent liability:( )

- All of the following are reported as current liabilities EXCEPT:( )

- When a business receives cash from a customer before earning the revenue, they credit: ( )

- Which of the following statements is TRUE regarding pension liabilities?( )

- Which of the following current liabilities is/are a known amount? ( )

- Which of the following statements is true in relationship to a company financing with debt rather than stock?( )

- On January 1st, XYZ Company issued $200,000, 5-year, 4% bonds. The market rate at the time of the sale was greater than 4% so the bonds were sold at 93,selling quantity is 2000. Interest is payable June 30th and December 31st. The entry to record the sale of the bonds would include a:( )

- Refer to Question 6. If the XYZ Company uses the straight-line method to amortize discount on the bonds, the entry to record the first interest payment would include: ( )

- Refer to Question 1. What is the amount of Interest Revenue recorded on July 1, 2014?( )

- The Ashley Corporation purchased $600,000 of 4%, 5-year bonds at 97 on January 1, 2014. Interest is to be paid semiannually on January 1 and July 1. This is a held-to-maturity investment. This company uses the straight-line method to amortize any premiums or discounts. What was the purchase price of these bonds?( )A.$600,000

- Under the equity method, when an investor company records its share of investee income,( )

- Which of the following is/are eliminated in the preparation of a consolidated balance sheet?( )

- On the purchase date, long-term available-for-sale equity securities are reported on the balance sheet at:( )

- The Unrealized Gain on Investment in Available-for-Sale Securities is reported in:( )

- Refer to Question 1. What is the carrying amount of the bond on July 1, 2014?( )

- Which statement regarding “available-for-sale investments” is true? ( )

- When an available for sale investment is sold:( )

- Which of the following is true regarding equity-method investments?( )

- Sullivan, Inc., purchased supplies for $1500 during 2021. At year-end, Sullivan had $400 of supplies left. The adjusting entry should ( )

- Beginning inventory is $100,000,purchases are $240,000,and sales total $430,000. The normal gross profit is 45%. Using the gross profit method, how much is ending inventory?( )

- When applying the lower-of-cost-or-market rule to inventory, "market' generally means ( )

- Mighty Corporation holds cash of $8,000 and owes $31,000 on accounts payable. Mighty has accounts receivable of $47,000, inventory of $28,000, and land that cost 40,000. How much are Mighty’s total assets and liabilities?( )

- Ringle Company purchased a machine for $10,200 on January 1,2021.The machine has been depreciated using the straight-line method over an eight-year life and $800 residual value. Ringle sold the machine on January 1,2023, for $8,900.What gain or loss should Ringle record on the sale?( )

- What is the effect on total assets and stockholders' equity of paying the telephone bill as soon as it is received each month?( )

- The entry to close Management Fee Revenue would be which of the following?( )

- Expenses normally have a credit balance.( )

- If a real estate company fails to accrue commission revenue, assets are understated, and net income is understated.( )

- In a bank reconciliation, an EFT cash payments is deducted from the bank balance.( )

- The objective of internal control is to maximize net income.( )

- Stock dividends reduce the total assets of the company. ( )

- A 2-for-1 stock split has the same effect on the number of shares being issued as a 50%stock dividend.( )

- Which of the following statements is TRUE?( )。

- "Case 7-1: Use the information below to answer Questions 1-6.A business purchased an asset that had a total cost of $110,000 and a residual value of $10,000. The asset is expected to service the business for a period of 10 years or produce a total of 1,000,000 units. The machine was purchased January 1st of the current year and has been in service one complete year. Refer to Case 7-1. What is the depreciable cost of the asset?"( )。

- The entry to record the annual depreciation does not include:( )。

- In calculating the total cost of land, all costs are included except:( )。

- If a plant asset is sold and a gain is incurred, the entry to record the sale would include a debit to:( )。

- Return on assets:( )。

- Refer to Case 7-1. Using the straight-line method, what is the amount of depreciation expense in Year two of the asset’s life?( )。

- Refer to Case 7-1. Now assume the business uses the units-of-production method. If the asset produces 250,000 units in Year 1 and 200,000 units in Year two, what is the amount of depreciation expense for Year two?( )。

- Refer to Case 7-1 and Question 3. What is the book value of the asset at the end of Year two, using the units-of-production method?( )。

- Refer to Case 7-1. What is the depreciation expense in Year one, if the double-declining-balance method is used?( )。

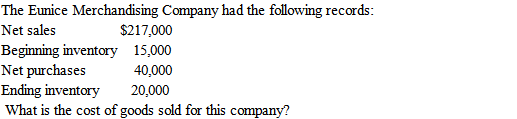

- Refer to Question 8. What is the gross profit for this company?( )。

- Inventory turnover:( )。

- The excess of sales revenue over cost of goods sold is:( )。

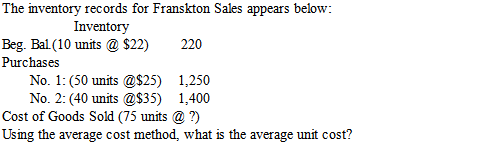

- Refer to Question 5. Using the average cost method, what is the cost of goods sold?( )。

- Refer to Question 5. What value is assigned to the ending inventory, if using FIFO?( )。

- The perpetual inventory system:( )。

- Cost of goods sold:( )。

- Merchandise inventory:( )。

- Which of the following about factoring a receivable is false?( )。

- Available-for-sale securities are reported on the balance sheet at:( )。

- An unrealized gain occurs:( )。

- Which method of writing off an uncollectible account does not violate the expense recognition principle?( )。

- When an accounts receivable account has been determined to be uncollectible the entry to record the write off using the allowance method would include:( )。

- Refer to Question 1. What is the maturity date of the note?( )。

- According to Question 1, What is the entry to record receipt of the payment, on the maturity date of the note?( )。

- On September 5, the XYZ Co. made a $2,500 credit sale, due in 30 days. On October 1, the customer requested and was granted an extension on the payment. The customer was required to sign a 60-day, 5% note on the day of the extension. Payment was made on the maturity date of the note. What is the entry on September 5 to record the credit sale?( )。

- Refer to Question 1. What is the maturity value of the note? (Round to the closest dollar)( )。

- Refer to Question 1. What is the entry to record the extension on October 1?( )。

- Use the following option to indicate where the items described in questions 9 would appear on the September bank reconciliation for the Johnson Company.Deposits in transit total $5,600.( )。

- Use the following option to indicate where the items described in questions 10 would appear on the September bank reconciliation for the Johnson Company.An NSF check from a customer for $800 appears on the September bank statement.( )。

- The book side of a bank reconciliation will include which of the following?( )。

- The Singletary Corporation had a beginning cash balance of $7,050 during the month of March. This company is expected to collect $4,500 from its outstanding accounts receivable. The projected cash sales for March are $9,000. The outstanding accounts payable balance is $10,000, of which 30% is to be paid during March. Operating expenses that are to be paid during March are projected to be $12,000. If preparing a cash budget for the month of March, what is the ending cash balance?( )。

- Use the following option to indicate where the items described in questions 7 would appear on the September bank reconciliation for the Johnson Company.Outstanding checks amount to $2,640 as of the end of September.( )。

- Use the following option to indicate where the items described in questions 8 would appear on the September bank reconciliation for the Johnson Company.The September bank statement reports $17 of interest earned.( )。

- Which of the following is not a component of internal control?( )。

- Lapping is:( )。

- Which of the following is NOT an element of the fraud triangle?( )。

- Which of the following is NOT a document used to control a bank account?( )。

- The company receives 36000 for a legal service of six-months in advance on October 1, 2014. What is the entry for the prepayment on October 1, 2014?( )。

- Refer to Question 6. What is the entry to make the necessary adjustment on December 31, 2014?( )。

- Which asset does not depreciate?( )。

- Which of the following is not a temporary account?( )。

- Which account needs an adjustment at the end of the period?( )。

- The supplies account has a $3,000 beginning balance. Supplies in the amount of $5,000 were purchased during the accounting period. An ending inventory revealed a $1,200 balance of supplies on hand. The entry to adjust the account accordingly is:( )。

- What is the account classification and normal balance of Prepaid Rent?( )。

- In adhering to the expense recognition principle:( )。

- Which of the following is a current liability?( )。

- A deferral is:( )。

- When a company sells merchandise, but the customer does not pay it immediately, it should:( )。

- An expense:( )。

- Each of the following is revenue except:( )。

- In analyzing a transaction using the accounting equation, which account is included in the Stockholders’ Equity section?( )。

- Which of the following accounts is decreased with a credit?( )。

- The XYZ Company received $1,000 for a customer on account. The entry to record this transaction is:( )。

- The ledger is:( )。

- A trial balance:( )。

- The journal is:( )。

- Which of the following accounts is decreased with a debit?( )。

- The ______ states that assets should be recorded at their actual cost.( )。

- Which financial statement reports revenues and expenses?( )。

- Mr. Ronald Smith is the owner of a small business. He has decided to save money during his initial years of operation by not hiring a professional accountant. He makes inflation adjustments to accounting information to make it comparable over time. Which accounting principle, concept, or assumption does this violate?( )。

- If total liabilities decreased by $75,000 and total assets decreased by $90,000 during the same accounting time period, what happened to total owners’ equity during this period?( )。

- Assuming an entity will continue to operate long enough to sell its inventories and convert any receivables to cash is( )。

- Which financial statement reports net income and dividends?( )。

- The equation for the Statement of Cash Flows is( )。

- Which item is an asset?( )。

答案:investing activities.

答案:$9,000.

答案:$14,000

答案:Other four choices might be included in “cash equivalents”.

答案:$24,200

答案:$0

答案:$175,000

答案:$121,000

答案:a credit Interest Revenue for $87.50

答案:an economic resource that's expected to benefit futureoperations.

答案:$57,300

温馨提示支付 ¥5.00 元后可查看付费内容,请先翻页预览!