第三章测试1.Select one or more correct statements about the performance of hedge fund:

( )

A:Many hedge fund strategies have low betas and therefore cannot be expected to outperform the market when it is doing well

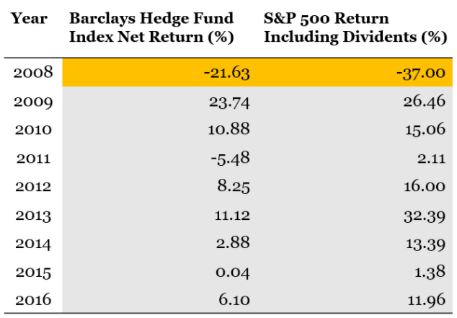

B:The Barclays Hedge Fund Index shows that hedge funds outperformed the market in 2008, but not between 2009 and 2016

C:The statistics may bias average hedge fund performance upward because only hedge funds that choose to report their returns are included in the statistics and these tend to be the hedge funds that are doing well

答案:ABC

2.A fund of funds divides its money between five hedge funds that earn –5%, 1%, 10%, 15%, and 20% before fees in a particular year. The fund of funds charges 1 plus 10% and the hedge funds charge 2 plus 20%. The hedge funds’ incentive fees are calculated on the return after management fees. The fund of funds incentive fee is calculated on the net (after management fees and incentive fees) average return of the hedge funds in which it invests and after its own management fee has been subtracted. What is the overall return on the investments?( )

A:5.4%

B:8.2%

C:10.2%

3.Long/short funds tend to invest primarily in publicly traded equity and their derivatives, and tend to be short biased.( )

A:对 B:错 4.Global macro strategy involves both directional analysis, which seeks to predict the rise or decline of a country’s economy, as well as relative analysis, evaluating economic trends relative to each other.( )

A:错 B:对 5.Global macro funds are not confined to any specific investment vehicle or asset class, and can include investment in equity, debt, commodities, futures, currencies, real estate and other assets in various countries.( )

A:对 B:错

温馨提示支付 ¥3.00 元后可查看付费内容,请先翻页预览!