第十一章单元测试

- Which of the following is true? ( )

- Which of the following is not an advantage of using standard costs? ( )

Which of the following is not true about standard costing systems? ( )

- For the fixed overhead volume variance, if production volume is greater than originally anticipated, the variance will be unfavorable . ( )

- Fixed overhead budget variance is the difference between actual fixed overhead and budgeted fixed overhead . ( )

- Dolphin Ceramics produces large planters to be used in urban landscaping projects. A special earth clay is used to make the planters. The standard quantity of clay used for each planter is 24 pounds. Dolphin uses a standard cost of $2.00 per pound of clay. Dolphin produced 3,125 planters in May. In that month, 78,125 pounds of clay were purchased and used at the total cost of $150,000. The direct material quantity variance is ( )

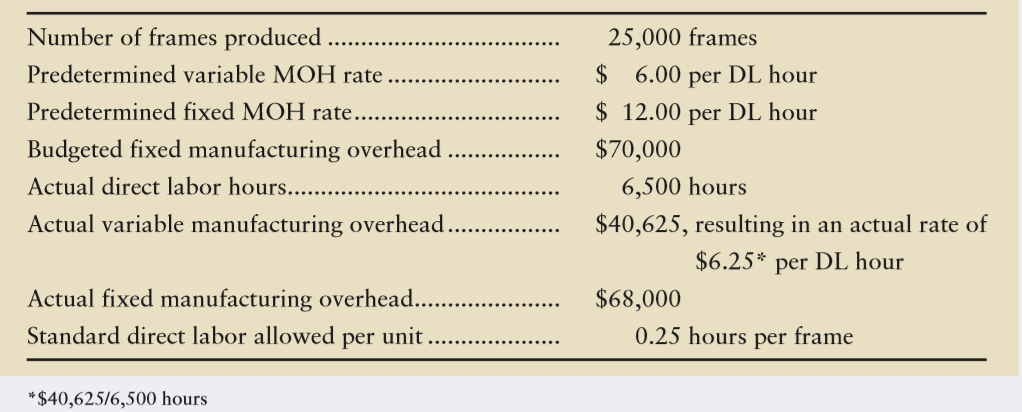

Vemoirs, Inc,produces several different styles and sizes of picture frames. The following activity describes its overhead costs during March, the variable overhead rate variances for the month of March is ( )- Direct Labor Rate Variance tells managers how much of the total labor variance is due to paying a higher or lower hourly wage rate than anticipated. ( ).

A company budgets to make and sell 4,000 units of its product, actual volume are 4,200 units. The product has a standard direct labor cost of $43. When analyzing its direct labor flexible- budget variance for the period, the company determined that its direct labor efficiency variance was an unfavorable variance of $8,600. Which one of the following is closest to the actual cost for direct labor if the total direct labor flexible- budget variance was an unfavorable variance of $4,400? ( )

一家公司预算生产和销售 4,000 件产品。 实际为 4,200件。该产品的标准人工成本为 43 美元。 在分析该期间的直接人工弹性预算差异时,该公司确定其直接人工效率差异为 8,600 美元的不利差异。 如果总直接人工弹性预算差异是 4,400 美元的不利差异,以下哪一项最接近直接人工的实际成本?

A company's master budget projected the following information.

一家公司的总预算预测了以下信息。

Sales (25,000 units) $250,000

Manufacturing costs (1/3 fixed) 120,000

Other operating costs (all fixed) 100,000

If the company actually sold 27,500 units, the operating income when using a flexible budget would be:如果公司实际销售 27,500 单位,则使用弹性预算时的营业利润为:( )

Frisco Company recently purchased 108,000 units of raw material for $583,200. 3 units of raw materials are budgeted for use in each unit of finished goods manufactured, and the raw material standard is set at $16.50 for each completed unit.

Frisco manufactured 32,700 finished units this period and used 99,200 units of raw material. If management is concerned about the timely reporting of variances in an effort to improve cost control and bottom-line performance, the materials purchase price variance should be reported as:

Frisco 公司最近以 583,200 美元的价格购买了 108,000 单位的原材料。 每生产一单位成品,预算使用 3 单位原材料,原材料标准定为每完成单位 16.50 美元。

Frisco 在此期间制造了 32,700 单位产成品,并使用了 99,200 单位原材料。 如果管理层关注及时报告差异以改善成本控制和底线绩效,材料采购价格差异应报告为:( )

A company is expected to produce 18,000 units in a certain month, and the actual output is 16,500 units. The direct material standard usage is 7.5 grams per unit, and the actual consumption is 6.5 grams . The standard price of raw materials is $6.75 per gram, and the actual price is $7 per gram. The Direct material usage variance is $111,375(Favorable), price variance is $26,813( Un-favorable), and total variance is $84,562( Favorable)

某公司预计在某月份产出18,000个产品,实际产出为16,500个产品。标准材料单耗()为每个产品7.5克原材料,实际耗用为每个产品6.5克原材料。原材料标准单价为每克$6.75, 实际单价为每克$7。直接材料使用差异为 $111,375(有利),价格差异为 $26,813(不利),总差异为 $84,562(有利)。 ( )

1. A company expects to produce and sell 100,000 units , with an estimated unit variable cost of $4/unit and a unit fixed cost of $2/unit. The company actually only produced 80,000 units and incurred a total cost of $515,000. Then the company's production cost variance is ( )

某公司预计生产销售100,000个产品,预计单位可变成本(variable cost per unit)为$4/个,单位固定成本( fixed cost per unit)为$2/个。公司实际仅生产了80,000个产品,且发生总成本(total cost) $515,000。则该公司生产成本差异(Production cost variance)为 ( )

A:Standards should never be updated .

B:Practical standards are based on ideal conditions

C:Ideal standards are based on currently attainable conditions

D:A standard cost is the budgeted cost for one unit

答案:A standard cost is the budgeted cost for one unit

A:Standards can cause unintended behavioral consequences

B:Standards serve as cost benchmarks

C:Standards can simplify bookkeeping.

D:Standards are useful for budgeting

A:A standard cost income statement shows cost of goods sold at standard, along with all of the variances needed to adjust cost of goods sold back to actual.

B:At the end of the period, the variances are closed to the Sales Revenue account

C:Each type of variance has its own general ledger account

D:Standard costs are used to record the manufacturing costs entered into the inventory accounts

A:对 B:错

A:错 B:对

A:$6250 unfavorable variance

B:$6200 unfavorable variance

C:$6250 favorable variance

D:$6200 favorable variance

A:$1,500 favorable variance

B:$1,625 unfavorable variance

C:$1,500 unfavorable variance

D:$1,625 favorable variance

A:对 B:错

A:$44 per unit B:$39 per unit C:$40 per unit D:$41 per unit

A:$43,000. B:$33,000. C:$47,000. D:$51,000.

A:$6,050 unfavorable. B: $10,800 favorable. C:$10,800 unfavorable. D:$9,920 favorable.

A:错 B:对

A:$85,000 unfavorable variance B:$5,000 unfavorable variance C:$35,000 unfavorable variance D:$5,000 favorable variance