第十二章单元测试

- All else being equal, a shorter payback period is more desirable than a longer payback period ( )

- The time value of money depends on which of the following factors? ( )

- Which of the following methods of analyzing capital investments factors in the time value of money? ( )

- In equipment-replacement decisions, which one of the following does not affect the decision-making process? ( )

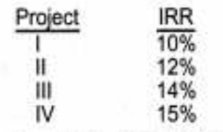

- Brown and Company uses the internal rate of return(IRR)method to evaluate capital projects, Brown is considering four independent projects with the following IRRs:

Brown's cost of capital is 13%. Which one of the following project options should Brown accept based on IRR?( ) - Jasper Company has a payback goal of 3 years on new equipment acquisitions. A new sorter is being evaluated that costs $450,000 and has a 5-year life. Straight-line depreciation will be used; no salvage is anticipated, Jasper is subject to a 40% income tax rate. To meet the company's payback goal, the sorter must generate reductions in annual cash operating costs of ( )

- The capital budgeting model that is generally considered the best model for long-range decision making is the ( )

- Which of the following methods calculates the investment's unique rate of return? ( )

- In order to convert the average annual net cash inflow from the asset back to the average annual operating income from the asset, one must ( )

- Which of the following methods focuses on the operating income an asset generates rather than the net cash inflows it generates? ( )

A:错 B:对

答案:对

A:Principal amount

B:Number of periods

C:Frees top management's time

D:Interest rate

A:All of the above methods factor in the time value of money .

B:Accounting rate of return

C:Payback period

D:Internal rate of return

A:Operating costs of the old equipment

B:Current disposal price of the old equipment

C:Cost of the new equipment.

D:Original fair market value of the old equipment

A:Project IV only.

B:Projects I and ll only.

C:Projects Ill and lV only.

D:Projects l,lll and lV.

A:$60,000

B:$150,000

C:$190,000.

D:$100,000

A:Discounted cash flow model.

B:Payback model.

C:Accounting rate of return model.

D:Unadjusted rate of return model.

A:Accounting rate of return

B:Internal rate of return

C:Payback period

D:Net present value

A:subtract annual depreciation expense

B:multiply by annual depreciation expense

C:divide by annual depreciation expense

D:add annual depreciation expense

A:Accounting rate of return

B:Payback period

C:Net present value

D:Internal rate of return

温馨提示支付 ¥3.00 元后可查看付费内容,请先翻页预览!